Published: March 2020 | Last Updated:January 2026

© Copyright 2026, Reddog Consulting Group.

So, what is Amazon Vendor Central? Think of it as the invite-only, first-party (1P) wholesale platform where brands sell their products to Amazon, not through Amazon. You act as the supplier, and Amazon becomes your single largest retail account.

In this model, Amazon buys your inventory at wholesale prices. From that point on, they're in the driver's seat—setting the final retail price, managing the product listing, and handling all fulfillment and customer service. It’s a fundamentally different business model compared to selling on the open marketplace, and understanding this distinction is the first step in building a solid Foundation for growth.

The relationship is simple: you're the manufacturer, and Amazon is the retailer. It’s the digital equivalent of a classic wholesale partnership with a big-box store like Target or Walmart. Amazon sends you a purchase order (PO), you ship the products to their designated warehouses, and they handle the rest.

This first-party (1P) model is the direct opposite of selling on Amazon Seller Central, where you operate as a third-party (3P) seller. On Seller Central, you’re in full control, listing your products on the marketplace and selling directly to individual customers.

If you’re building your omnichannel strategy, clarifying the difference between these platforms is a critical first step. Our guide on what Seller Central is and why it matters breaks down the 3P model in more detail.

To put it in perspective, let's compare the two side-by-side.

This table breaks down the core differences between the two primary ways brands can sell on Amazon. Understanding these distinctions is key to deciding which path aligns with your business model and long-term growth objectives.

| Aspect | Amazon Vendor Central (1P) | Amazon Seller Central (3P) |

|---|---|---|

| Business Model | Wholesale: You sell to Amazon. | Marketplace: You sell through Amazon to customers. |

| Control Over Pricing | None. Amazon sets the retail price. | Full control. You set your own prices. |

| Inventory Management | You fulfill Amazon's Purchase Orders. | You control your own stock levels. |

| Customer Interaction | Amazon handles all customer service. | You manage customer service directly. |

| Payment Terms | Longer wholesale terms (Net 30, 60, or 90). | Bi-weekly payouts (every 14 days). |

| Access | Invite-only. | Open to almost any brand. |

| Ideal For | Established brands with high volume & strong operations. | Brands wanting control, flexibility, and higher margins. |

While both platforms get your products in front of Amazon's massive customer base, the operational reality and financial mechanics couldn't be more different.

In the Vendor Central world, Amazon’s primary goal is to acquire your products at the lowest possible cost to sell them for a profit. This simple fact drives every negotiation and interaction you'll have.

Here’s a practical look at the day-to-day:

This 1P relationship is built for scale. It’s designed for established brands that can handle large, consistent orders and have the operational backbone to navigate the complexities of a wholesale partnership.

At its core, Vendor Central is Amazon's exclusive platform for its first-party suppliers. This model was a cornerstone of Amazon's retail strategy from the beginning and has powered billions in annual revenue. While Seller Central has grown massively, the 1P model still accounts for nearly half of all products sold on the platform.

Ultimately, accepting a Vendor Central invitation is a massive strategic choice. It will fundamentally change your margins, your operational focus, and your level of brand control, paving the way for either explosive growth or a mountain of new challenges.

To truly understand what Amazon Vendor Central is, you have to look beyond the simple wholesale agreement and into its operational and financial engine. This isn't just about selling in bulk; it’s about integrating your entire business into Amazon's automated, data-driven retail machine. The system is built on precision and predictability—and the scales usually tip in Amazon's favor.

It all begins with a purchase order (PO). Unlike a traditional retail partnership where you might negotiate orders with a human buyer, Amazon’s POs are generated by an algorithm. This system analyzes historical sales data, demand forecasts, and inventory levels to decide what to buy and when. Your job sounds simple but is a beast in practice: confirm and fulfill these orders with near-perfect accuracy.

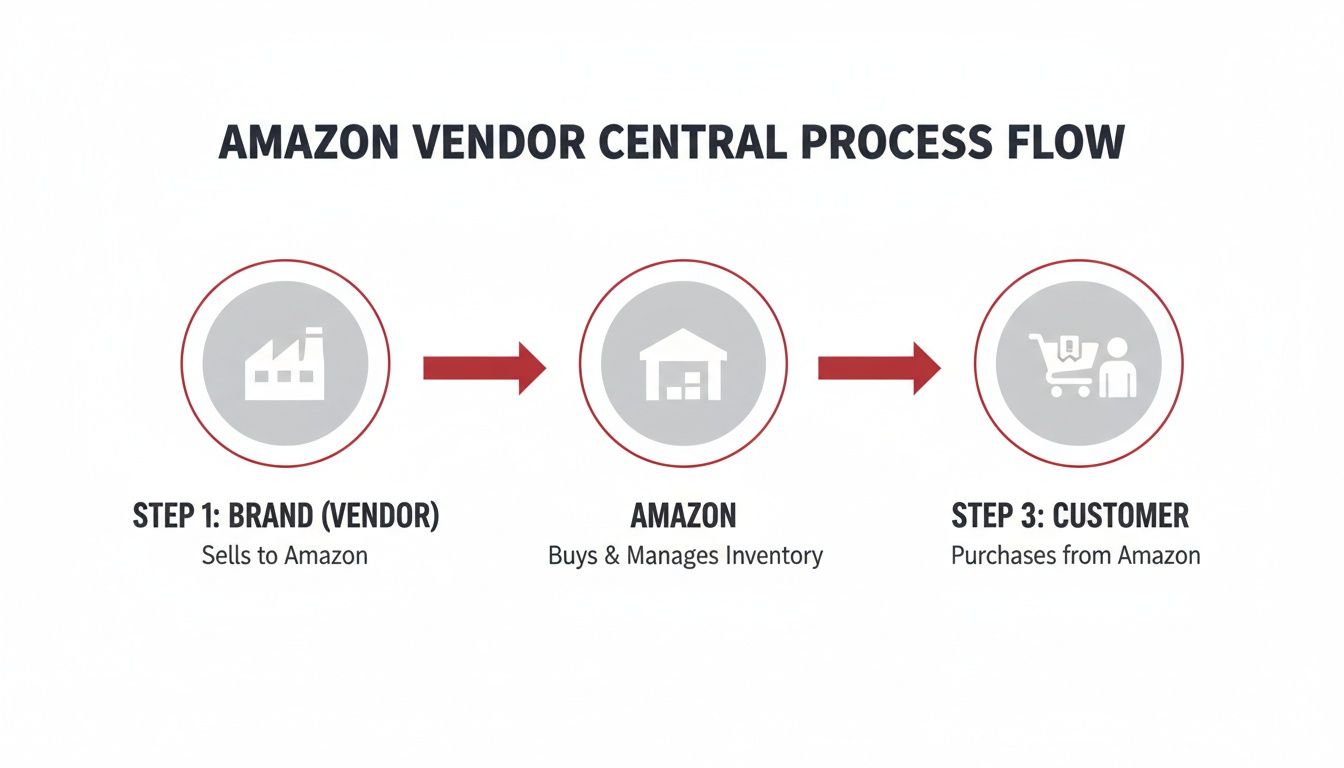

This flow chart illustrates the journey of a product from your brand to the customer within the Vendor Central model.

As the visual makes clear, your direct relationship is only with Amazon. They own the entire customer-facing experience from that point forward.

Once you ship the product, you enter the financial side of the partnership—which is where many brands get tripped up. You'll submit an invoice, usually through an Electronic Data Interchange (EDI) system, and then the waiting game begins. Amazon operates on standard wholesale payment terms, which means you won’t see your money for 30, 60, or even 90 days.

This long cash cycle is a significant operational hurdle compared to the 14-day payouts on Seller Central. It demands a rock-solid financial foundation and meticulous cash flow management, especially for growing brands reinvesting in inventory. But delayed payments are just the start; the real challenge is protecting your margins from a complex web of deductions.

Vendor Central's financial model is a game of inches. While the top-line revenue from large POs looks impressive, the net payment you receive can be significantly smaller after Amazon applies various fees, allowances, and penalties. Diligent financial tracking isn't just good practice—it's essential for survival.

These deductions, often called chargebacks, are automated penalties for failing to follow the rules. Even minor mistakes can trigger them, slowly eroding your profitability.

Common reasons for chargebacks include:

Each issue triggers a small fine. Multiplied across thousands of units and hundreds of shipments, it can turn into a substantial revenue loss. This is precisely why a bulletproof operational setup is non-negotiable for any brand considering the vendor path.

Let's make this tangible. Imagine a hypothetical $100 wholesale PO for a popular kitchen gadget. That initial $100 is just the starting line.

Here’s how quickly that $100 can shrink:

In this simple scenario, your $100 order has become a $90 payment—and that’s before factoring in your own cost of goods. For brands on thin margins, this 10% reduction can be the difference between profit and loss. It’s a powerful lesson: success on Vendor Central isn't just about winning large orders. It’s about mastering the operational details to protect every single percentage point of your margin.

Stepping into a vendor relationship with Amazon is a massive opportunity, but it’s also a strategic crossroads. It’s a move that can supercharge your growth or slowly squeeze the life out of your profit margins. Before you consider accepting that invitation, you need a brutally honest assessment of both the incredible upside and the very real downside.

On one hand, Amazon offers a scale and credibility that’s almost impossible to build on your own. On the other, you're handing over the keys to your brand's pricing and customer experience. Getting this balance right from day one is everything.

The most powerful benefit of being a vendor is the phrase on your product page: "Ships from and sold by Amazon.com". To a shopper, that’s an instant seal of approval. It signals authenticity, reliability, and the Prime shipping they’ve come to expect. For many brands, that badge alone is enough to produce a measurable lift in conversion rates.

Beyond the trust factor, the operational relief is a huge draw. Once Amazon issues a purchase order and you ship the inventory to their fulfillment center, your job is largely done.

Amazon takes the wheel on the entire customer-facing operation, including:

For brands that lack the warehouse space or desire to run a complex direct-to-consumer operation, this is a game-changer. You also unlock exclusive marketing tools, like A+ Premium Content and the Amazon Vine program, which are powerful ways to make your listings stand out.

Of course, all those benefits come at a steep cost. The biggest shock for most new vendors is the complete loss of control over retail pricing. The moment Amazon owns your inventory, its pricing algorithms take over. Their goal is to win the Buy Box and maximize sales, period. That almost always means aggressive discounting that can crush your margins and create serious channel conflict with your other retail partners.

The core tension of Vendor Central is simple: you gain scale but surrender control. Amazon's priority is its own retail margin, not yours. This dynamic forces vendors to operate with extreme precision to protect profitability against constant downward price pressure.

And the pressure doesn’t stop at pricing. The operational rules are rigid and unforgiving. As we've covered, tiny mistakes when fulfilling purchase orders—a late shipment, a misplaced label—trigger automatic fines called chargebacks. These can bleed you dry, turning what looked like a profitable PO into a loss.

Then there's the cash flow. Sellers on Seller Central get paid every two weeks. As a vendor, you're looking at Net 30, 60, or even 90-day payment terms. This slower payment cycle requires deep pockets to float the cost of inventory and operations while you wait for Amazon to pay.

To make things clearer, let's break down the core trade-offs.

This table lays out the fundamental give-and-take that every brand must weigh before committing to the 1P model.

| Key Benefits (The Upside) | Key Drawbacks (The Downside) |

|---|---|

| Instant Credibility: The "Sold by Amazon" badge boosts consumer trust and conversion. | No Pricing Control: Amazon’s algorithms dictate retail prices, risking margin erosion. |

| Simplified Operations: Amazon handles fulfillment, customer service, and returns. | Strict Compliance: Rigid operational rules lead to costly chargebacks for minor errors. |

| Predictable Revenue: Bulk purchase orders create a more stable forecasting model. | Longer Payment Terms: Net 30-90 day terms can create significant cash flow challenges. |

| Exclusive Marketing Tools: Access to A+ Premium Content and Amazon Vine. | Limited Brand Control: Amazon has the final say on listing content and updates. |

Ultimately, the choice comes down to your brand’s DNA. Are you built for high-volume, lower-margin wholesale, and can your operations handle the strict demands? Or do you need the control, agility, and higher margins that come with selling directly to consumers? Answering that question is the first critical step in your Amazon journey.

So, how do you get into Vendor Central? Unlike Seller Central, you can't just sign up. It’s an exclusive, invite-only platform. When that email from an Amazon retail buyer finally lands in your inbox, it means your brand is officially on their radar.

But getting noticed isn't about luck. It’s about building a brand that Amazon sees as a future high-volume partner. Their vendor managers are constantly scouting for brands with strong, predictable demand and the operational chops to handle a true wholesale relationship.

What does it take to get that invite? Most brands don't just wait around; they proactively build a case so compelling that Amazon can't ignore them.

Here are the most common triggers that get you noticed:

An invitation to Vendor Central isn't just a sales opportunity; it's a signal that your brand has achieved a certain level of operational maturity and market demand. The real work begins when you start negotiating the terms of the partnership.

Once the invitation arrives, you enter a critical negotiation phase. This is your one real shot to set the financial foundation of your entire 1P relationship, so don't rush it. You'll be establishing everything from wholesale costs to how and when you get paid.

During this stage, you’ll need to agree on:

After you’ve agreed to the terms, the technical onboarding begins. This is a detail-oriented process where you’ll complete your account setup, integrate your product catalog, and prepare your systems to handle purchase orders and invoices, usually through an Electronic Data Interchange (EDI) system.

It is absolutely crucial to have your operational house in order before you say yes. Make sure you have valid GS1 UPCs for every product and confirm your warehouse is ready to meet Amazon's strict compliance standards from day one. Getting this initial setup right will make or break your profitability as a vendor.

Once you're live on Vendor Central, the real work begins. From this point forward, success is won or lost in the operational trenches. Amazon grades your performance relentlessly, and your ability to meet their standards directly impacts your profitability and the health of your partnership.

Flawless execution becomes your most valuable asset. Even small, repeated errors in your supply chain can trigger a cascade of penalties that systematically drain your profits. Mastering your operational metrics isn’t just about dodging fees; it’s about proving to Amazon that you are a reliable, low-risk partner worthy of their trust—and their purchase orders.

Your command center for operational health is the Operational Performance dashboard, often called the "Vendor Scorecard." This is where Amazon provides transparent data on how well you’re meeting their strict requirements. Consistently poor scores here can lead to smaller POs or even an account suspension.

Working in tandem is the Financial Scorecard, which tracks every deduction and chargeback hitting your account. Monitoring both is non-negotiable for protecting your margins. Top-performing vendors live in these scorecards, checking them daily to catch small issues before they snowball.

You need to become obsessed with a few core metrics:

Achieving operational excellence is about building a system of accountability. Every chargeback is a data point showing a crack in your process. The goal is to move from a reactive, "dispute-the-fee" mindset to a proactive, "fix-the-root-cause" strategy.

Protecting your margins requires building a bulletproof warehouse and fulfillment process. There’s no room for "good enough" in the Vendor Central world. Your team has to treat every Amazon PO with absolute precision, as if a single mistake on a label could cost the company thousands—because it can.

The first step is implementing strict, documented procedures for every part of the fulfillment process. Understanding concepts like Vendor Managed Inventory (VMI) can also provide a solid framework for optimizing your stock flow and cutting costs. You can explore some key Vendor Managed Inventory benefits to see how these principles could apply to your own operations.

For a deeper dive into the numbers, check out our complete guide on why tracking inventory performance is crucial for growth.

Here are a few practical strategies you can implement immediately:

Ultimately, your operational performance is a direct reflection of your brand's commitment to the 1P partnership. By mastering these metrics, you not only protect your profits but also build the trust necessary for a sustainable, long-term relationship with Amazon.

Choosing between Vendor Central and Seller Central is a defining moment for a brand. It's a strategic fork in the road that dictates your pricing power, operational reality, and growth potential on the world's biggest eCommerce stage. There’s no magic formula here—the right answer is baked into your business’s unique DNA, your goals, and your operational maturity.

This decision is a cornerstone of your brand's Foundation. Get it right, and you're set up for effective Optimization and Amplification later on. Get it wrong, and you'll feel the friction in every part of your strategy.

Vendor Central is typically a great fit for established, high-volume brands that have their operations dialed in. Think of companies that can absorb lower per-unit margins in exchange for massive scale and simplified logistics. They need the financial stability to handle Net 60 or Net 90 payment terms and the operational muscle to meet Amazon's rigid compliance rules without being eroded by chargebacks.

This is the natural habitat for large CPG brands or manufacturers with a strong brick-and-mortar presence. For them, Amazon is just another massive retail account, and the wholesale model slots perfectly into their existing business structure.

On the flip side, Seller Central is often the perfect launchpad for emerging DTC brands, businesses with high-margin niche products, or anyone who demands absolute control over their brand story and customer experience. It provides the agility to test new products, adjust pricing on the fly, and build a direct line of communication with customers.

This model is built for brands that value margin over sheer volume and need the flexibility to pivot quickly. And let's be honest, those bi-weekly payouts are a game-changer for managing cash flow, especially during rapid growth.

The choice isn't just about 1P versus 3P; it's a fundamental question of business strategy. Are you built to be a high-volume supplier or a nimble, direct-to-consumer brand? Answering this honestly is the key to sustainable success on the platform.

To cut through the complexity, you need to ask some tough questions about your brand’s readiness and long-term vision. The answers will point you toward the model that actually fits.

Ultimately, the decision to sell on Amazon is just step one. To get the full picture, check out our deep dive into whether it's worth selling on Amazon in the first place. This will help you frame your choice within a broader growth strategy.

Making the right call between Vendor and Seller Central is one of the most impactful decisions you'll make. If you’re weighing your options and need a clear path forward, let’s map out a strategy that fits your brand.

Let's Talk Growth

To wrap things up, let's tackle some of the most common questions brands have when they start looking into Amazon Vendor Central. Think of this as the quick-and-dirty guide to navigating the big considerations.

Nope, you can't. Vendor Central is strictly invite-only. Unlike Seller Central, where just about anyone can register, you have to wait for Amazon’s retail teams to come to you. They’re constantly scouting for brands that are a good fit, so the best way to get on their radar is to build a ton of sales momentum on Seller Central or generate serious buzz for your brand off-Amazon.

Despite all the rumors you might hear, Amazon is not phasing out Vendor Central. It’s a massive, core part of their retail strategy, especially for stocking household-name brands and top-selling products. While they might be getting a bit pickier with who they invite, the 1P model is fundamental to how Amazon keeps high-demand items in stock and competitively priced.

This is where things get really different from the seller world. Amazon pays its vendors on standard wholesale terms, which can be a shock to the system if you're used to quick payouts.

It's a world away from Seller Central's bi-weekly deposits, and it's one of the biggest financial hurdles to clear.

The leap from 14-day payouts to waiting 90 days for your money is a game-changer. It completely redefines how you manage your capital and demands serious cash flow forecasting just to keep the lights on.

While there’s no monthly subscription fee for Vendor Central, don't be fooled—the costs are built directly into the wholesale relationship and can seriously eat into your margins. Forget a simple cost of goods; you need to budget for a variety of deductions that Amazon will take right out of your invoices.

These fees often include:

The only way to protect your profit margins is through sharp negotiation and nearly flawless operations.

Navigating the world of Vendor Central is no small feat—it demands a solid grasp of its financial and operational rules. At RedDog Group, we specialize in helping brands craft profitable omnichannel strategies, whether that means going all-in on the 1P model, mastering the 3P marketplace, or finding the right hybrid approach.

If you're ready to scale with a clear, data-driven plan, we should talk.

1500 Hadley St. #211

Houston, Texas 77001

growth@reddog.group

(713) 570-6068

Amazon

Walmart

Target

NewEgg

Shopify

Leave a comment: