Published: March 2020 | Last Updated:December 2025

© Copyright 2026, Reddog Consulting Group.

Is selling on Amazon worth it? The short answer is yes—if you have a rock-solid omnichannel strategy. The platform offers a direct line to millions of high-intent customers, but it's also a fiercely competitive arena with a rulebook that's constantly changing.

For many brands, the thought of selling on Amazon feels like a necessary gamble. On one hand, you can’t ignore the sheer size of the marketplace. On the other, the fees, competition, and operational headaches can feel completely overwhelming.

This isn’t just about listing a product online. It's about launching a new, high-stakes sales channel that must integrate seamlessly with your entire business, from your DTC site to your physical retail presence.

To make the right call, you need to move past a simple pros-and-cons list and adopt a strategic framework. A proven approach is to break it down into three distinct stages of omnichannel growth:

Before we go further, it's helpful to see the big picture. The table below breaks down the high-level opportunities and challenges you'll face.

| Factor | The Opportunity (Pro) | The Challenge (Con) |

|---|---|---|

| Market Access | Instant access to a massive, high-intent customer base. | Fierce competition from millions of other sellers. |

| Fulfillment | Amazon FBA handles storage, packing, and shipping, enabling rapid scaling. | FBA fees can be complex and eat into margins if not managed precisely. |

| Growth Potential | The ability to scale sales rapidly without building your own fulfillment infrastructure. | High dependency on a single platform with constantly changing rules. |

| Brand Control | A new channel to build brand awareness with a global audience. | Risk of counterfeiters, price erosion, and unauthorized sellers diluting your brand. |

| Profitability | Potential for high-volume sales and significant revenue growth. | Margins are often thinner due to referral fees, ad costs, and other expenses. |

This table gives you a quick snapshot, but the real decision lies in the details. Each of these points has layers of complexity that can either make or break your success on the platform.

The data doesn't lie: independent brands aren't just participating on Amazon—they’re driving its growth. Third-party sellers now account for 62% of all sales, a huge leap from just 45% a decade ago.

This shift proves that independent businesses are the real engine of Amazon's retail ecosystem. The average U.S. seller is now generating an impressive $290,000 in annual sales. You can explore the latest Amazon marketplace seller statistics to see just how significant this opportunity has become.

Success on Amazon isn’t about luck; it's about building a defensible strategy. By methodically addressing your foundation, optimizing your operations, and amplifying your reach, you transform the platform from a risky bet into a calculated and measurable growth channel.

This guide is your strategic playbook. We'll walk you through a data-driven path to help you make an informed decision and build a profitable presence on the world's largest marketplace.

Before diving deep, our complete guide to expanding on Amazon offers essential background on why this move can be a game-changer for your brand. Let's get started.

Before you dream about revenue, a winning Amazon strategy starts with mastering your numbers. This is the Foundation pillar of our growth framework, and it's non-negotiable. Launching on Amazon without a rock-solid grasp of the complete cost structure is like building a house on sand—it might look good for a moment, but it's guaranteed to collapse under pressure.

Many brands get tripped up here. They fixate on the most obvious expense—the referral fee—and completely miss the bigger picture. The true cost of selling on Amazon is a layered financial puzzle, and you need to see every piece to know if this marketplace is a profitable fit for your brand.

Amazon’s fees aren't just a single line item. They’re a collection of charges that vary based on your product category, fulfillment method, and sales velocity. Think of it less like a simple price tag and more like a utility bill with a dozen different usage-based charges.

The two core fees you must master are:

Don't forget about storage. Amazon charges monthly inventory storage fees based on the cubic footage your products occupy in their warehouses. These rates spike during the Q4 holiday rush (October–December) and for any inventory that sits too long.

Profitability on Amazon extends far beyond platform fees. Many brands get blindsided by the other investments required to gain traction and maintain sales momentum. Ignoring these can make your margins vanish.

Be sure to factor in these key "hidden" costs:

Understanding your unit economics—the revenue and costs tied to selling a single item—is the single most important financial exercise for any Amazon seller. It's the difference between scaling profitably and scaling yourself into a loss.

Let's make this tangible. Imagine you're selling a set of premium kitchen tongs. Here’s a simplified breakdown of your numbers for a single sale:

| Cost Component | Description | Amount |

|---|---|---|

| Retail Price | The price the customer pays on Amazon. | $30.00 |

| Cost of Goods Sold (COGS) | Your cost to manufacture or source the product. | -$7.00 |

| Referral Fee (15%) | Amazon's commission on the sale. | -$4.50 |

| FBA Fulfillment Fee | Cost for Amazon to pick, pack, and ship. | -$5.50 |

| Monthly Storage Fee (Est.) | Your product's share of FBA storage costs. | -$0.25 |

| Advertising (10% of Price) | Your estimated ad cost per unit sold. | -$3.00 |

| Net Profit (Per Unit) | Your profit before overhead and taxes. | $9.75 |

In this scenario, your net margin is 32.5% ($9.75 / $30.00). This number is your foundation. When building your financial foundation and understanding the true costs of selling online, it's essential to consider how specialized e-commerce accounting services can impact your profitability. With this clarity, you can confidently decide if selling on Amazon is a worthwhile move for your business.

Once you've nailed down the financials (Foundation), it's time to build your operational engine (Optimization). This is where you make the critical decisions that determine how efficiently you can run your business and how well you can protect your brand identity on the marketplace. The two biggest decisions are your fulfillment model and your brand control strategy.

Think of fulfillment as the engine of your Amazon store. It powers your shipping speed, shapes the customer experience, and determines whether you earn the coveted Prime badge. Make the wrong choice, and you're facing logistical nightmares and unhappy customers. Get it right, and your operations will run like a well-oiled machine.

On Amazon, you have two primary options for getting products to customers: Fulfillment by Amazon (FBA) or Fulfillment by Merchant (FBM). Each path has significant implications for your margins, your daily workload, and your customers' experience with your brand.

Fulfillment by Amazon (FBA) is the "let Amazon handle it" approach. You send your products in bulk to Amazon's warehouses, and they take over storage, picking, packing, shipping, and customer service for delivery-related issues. The single biggest benefit? Your products are instantly eligible for the Prime badge, a massive driver of consumer trust and sales. But this convenience comes at a cost. You'll pay storage and fulfillment fees that can erode your profits, especially for slow-moving or oversized items.

Fulfillment by Merchant (FBM) keeps you in complete control. You store your own inventory and are responsible for packing and shipping every order directly to the customer. This model gives you total command over your branding and packaging, and it can be more cost-effective for certain products. The tradeoff is significant: you won't automatically get the Prime badge, and you must meet Amazon's incredibly strict shipping performance standards on your own.

To make the right call, you need to analyze your products, operational capacity, and strategic goals.

Deciding between FBA and FBM is a foundational choice for any brand on Amazon. This comparison lays out the core differences to help you align your fulfillment strategy with your specific products, operational strengths, and business goals.

| Feature | Fulfillment by Amazon (FBA) | Fulfillment by Merchant (FBM) |

|---|---|---|

| Prime Eligibility | Automatic, a key driver for customer trust and sales. | Not included, making it harder to compete on shipping speed. |

| Logistics | Amazon handles all storage, packing, and shipping. | You are responsible for all fulfillment logistics. |

| Customer Service | Amazon manages fulfillment-related inquiries and returns. | You handle all customer communication and returns. |

| Control | Less control over packaging and the unboxing experience. | Full control over branding, packaging, and shipping partners. |

| Cost Structure | Pay for storage, pick & pack, and shipping fees to Amazon. | Avoid FBA fees, but incur your own warehousing and shipping costs. |

So, what's the verdict? FBA is typically the go-to for high-volume, standard-sized products where speed is critical. FBM is often a better fit for brands with low-volume, oversized, or custom items, or for those who already have a sophisticated in-house fulfillment operation. For a deeper analysis, our guide on whether Amazon FBA is worth it for your brand in 2024 provides more detailed insights.

Choosing a fulfillment method is only half the puzzle. The other crucial piece is actively controlling how your brand is presented on Amazon. The marketplace can be like the Wild West—if you don't stake your claim and defend your territory, someone else will.

Brand control on Amazon isn't a "set it and forget it" task. It's an ongoing process of defending your listings, managing your pricing, and ensuring customers receive an authentic experience every single time.

This boils down to three core actions:

Juggling these moving parts requires sharp operational management. To get a clear view of everything, many brands see how an operations dashboard can aid optimization by tracking inventory, sales data, and seller activity from a single screen. By locking down both your fulfillment process and your brand presence, you build a stable, protected platform for scalable growth.

With a solid financial foundation and optimized operations, it’s time for Amplification. This is where you transition from simply having a product on Amazon to actively winning your category. It’s about leveraging the platform’s massive scale to turn a new listing into a market leader and drive measurable brand growth.

Getting this right isn't about luck. It’s a systematic process of understanding the market, identifying your competitors' weaknesses, and launching with a plan to build unstoppable momentum. This is how you confidently answer the "is it worth it?" question with a resounding yes.

Before you invest in inventory, you must validate that people are actively searching for what you’re selling. Guessing is a fast track to failure. A data-first approach to demand analysis is the only way to proceed.

Think of it like a developer scouting a location before construction. You need to know the foot traffic, who the other shops are, and what the community is actually looking for. On Amazon, this means using data to answer critical questions:

Once you've confirmed a hungry market exists, you need to know who you're up against. A deep dive into your competition isn't about copying them—it’s about finding the gaps they’ve left wide open for you to exploit.

Look for vulnerabilities. Are their product photos low-quality? Do their customer reviews repeatedly mention a specific flaw that your product solves? Is their branding generic? Every weakness is an opportunity for you to create a unique selling proposition that shoppers can’t ignore.

A crowded market isn't a red flag—it's proof of demand. Your goal isn't to be the only option. It's to become the best option for a specific segment of that market by exploiting your competitors' weaknesses.

With a clear picture of the market and your competition, you can engineer a powerful launch. A successful launch is all about generating early sales velocity. This is crucial because Amazon’s A9 algorithm rewards products that sell well from day one with higher search rankings, creating a flywheel of visibility and sales. A strong launch typically includes:

The potential to scale on Amazon is staggering. The number of sellers hitting seven figures grew from 60,000 in 2021 to over 100,000 globally today. In 2024, independent US sellers averaged over $290,000 in annual sales, proving the platform is a serious growth engine. You can find more seller success stories on Amazon's own forums. By mastering the amplification phase, brands can transform Amazon into a predictable and highly scalable revenue machine.

Let's be clear: while the growth potential on Amazon is immense, it’s an ecosystem that operates by its own rules. Being prepared for the unexpected is essential. Understanding the risks isn't about deterrence—it's about building resilience into your strategy from day one.

The goal is to move forward with confidence, knowing you have a plan to protect your brand and your revenue. When you anticipate the challenges, you can turn potential disasters into manageable issues and keep your business growing.

For any seller, the biggest fear is a sudden, often automated, account suspension. It can be triggered for various reasons—a spike in negative feedback, an accidental policy violation—and it instantly halts your sales. Think of it as Amazon pulling the emergency brake on your business without warning.

Reinstating your account requires a carefully crafted Plan of Action (POA) that addresses the root cause of the problem. This isn't just an apology; it's a formal document demonstrating that you’ve identified the issue and implemented concrete steps to prevent it from happening again.

The key to surviving a suspension is proactive compliance and a deep understanding of Amazon's Seller Code of Conduct. Don't just skim the rules—internalize them. This is your best defense against being blindsided.

Another persistent challenge comes from bad actors trying to profit from your hard work. Listing hijackers are unauthorized sellers who attach themselves to your product page, often selling counterfeit versions or undercutting your price to steal the Buy Box. This not only costs you sales but also damages your brand's reputation with inferior products.

Your best line of defense is Amazon Brand Registry. Enrolling your trademark provides access to powerful tools for reporting and removing these fraudulent sellers, controlling your listing content, and protecting your intellectual property. Vigilant monitoring of your listings is also critical—you can't afford to let hijackers run rampant.

The Amazon landscape is in constant flux. A policy update can change your fulfillment requirements overnight. A coordinated attack of negative reviews—whether from a competitor or disgruntled customers—can destroy your product's rating and kill its sales momentum.

To mitigate these risks, you need a robust system for monitoring and responding to customer feedback. Here’s a practical approach:

By treating risk management as a core part of your Amazon strategy—just as important as marketing or inventory planning—you build a more durable business prepared to handle challenges and continue scaling with confidence.

You’ve weighed the costs, fulfillment models, and potential challenges. Now it's time for the final checkpoint. This is where you synthesize the information and make a clear-eyed, strategic decision on whether Amazon is the right move for your brand right now.

Think of this as an honest self-assessment. It’s not about achieving a perfect score but about understanding your strengths and being realistic about where you need to improve. Use these questions for a final internal gut-check before committing resources to the marketplace.

First, are your finances and product strong enough to compete? Without healthy margins and a differentiated product, even the most brilliant strategy will fail.

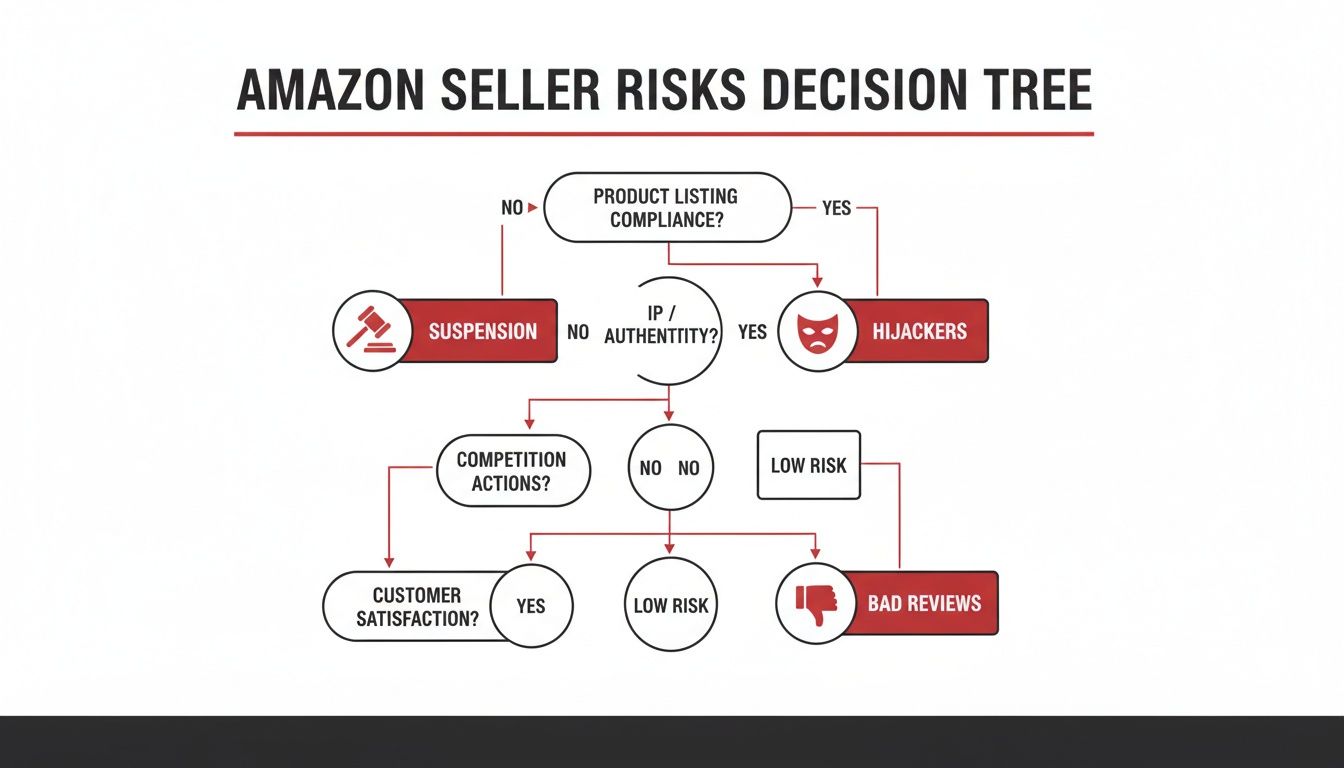

This decision tree gives you a visual of the most common landmines sellers step on: account suspensions, listing hijackers, and a flood of bad reviews.

Knowing these risks upfront is what separates a resilient strategy from one that shatters at the first sign of trouble.

Next, let's talk operations. Does selling on Amazon align with your broader brand goals, and do you have the team to execute? This isn't just another sales channel—it's a new operational arm of your business.

Selling on Amazon is a commitment to a new ecosystem with its own rules. Success requires dedicated resources for inventory management, performance monitoring, and continuous optimization—it is not a 'set it and forget it' channel.

If you’ve gone through this list and the answer is a confident "yes," your next move isn't to go all-in. It's to launch a controlled pilot.

Start small. Select a handful of your best-performing SKUs and get them live. This approach minimizes risk while providing invaluable real-world data on everything from customer feedback to actual profitability. From day one, track key metrics like your TACoS (Total Advertising Cost of Sale), conversion rates, and session data.

As you grow, you'll reach a point where managing it all in-house becomes a bottleneck. When you’re ready to scale your Amazon presence aggressively, it's time to bring in an expert partner who has a proven track record of driving growth on the platform.

Even with a clear game plan, a few big questions always pop up. Here are straightforward, practical answers to what we hear most often from brands evaluating if Amazon is the right move for them.

While you can technically start with a small budget, a serious launch requires investment. Most sellers (64%) get started with $5,000 or less.

This budget typically covers your Professional Seller plan ($39.99/month), your initial inventory order, and enough advertising spend to gain early traction. Attempting it for under $1,000 is possible but makes it incredibly difficult to generate meaningful momentum.

This depends heavily on your product, niche competitiveness, and launch strategy, but it can happen faster than you think. A significant portion of sellers—35%—report turning a profit within the first six months.

Brands that enter the marketplace with a well-funded and dialed-in strategy often achieve profitability in under three months. The key is mastering your unit economics from day one.

Absolutely. The marketplace is competitive, but it’s also massive. The goal isn’t to be the only one selling a product; it’s to be the best choice for a specific customer segment.

The proof is in the results: 57% of sellers achieve profit margins over 10%, and nearly a third report lifetime profits exceeding $50,000. If you have a strong brand and a clear value proposition, there is ample room to succeed.

FBA is an incredibly powerful tool, especially for securing the Prime badge and outsourcing logistics. That's why a staggering 82% of sellers use it.

However, it’s not a one-size-fits-all solution. If you’re selling oversized items, products with thin margins, or items with slow turnover, FBA’s storage and fulfillment fees can eliminate your profits. In those cases, Fulfillment by Merchant (FBM) provides greater control and can be far more cost-effective.

Ready to move from asking questions to building a dominant Amazon presence? At RedDog Group, we use our proven Foundation → Optimization → Amplification framework to turn marketplace potential into measurable revenue. Let's Talk Growth.

1500 Hadley St. #211

Houston, Texas 77001

growth@reddog.group

(713) 570-6068

Amazon

Walmart

Target

NewEgg

Shopify

Leave a comment: