Published: March 2020 | Last Updated:January 2026

© Copyright 2026, Reddog Consulting Group.

In the Walmart Marketplace vs. Amazon debate, the strategic choice for your brand boils down to a simple reality: Amazon is a mature, high-traffic giant with intense competition, while Walmart Marketplace is the fast-growing challenger offering a less crowded path to a massive omnichannel audience.

The right platform isn’t the biggest one—it’s the one that aligns with your brand’s growth stage and goals. Are you ready to compete in a hyper-saturated, global arena? Or could your brand achieve faster, more profitable growth in a curated environment with direct access to America’s largest retailer?

Deciding between Amazon and Walmart isn't just about listing products on another site; it's a strategic move that defines your brand’s omnichannel future. This choice connects your online marketplace strategy with your direct-to-consumer (DTC) channels and even your physical retail presence, creating a powerful, integrated customer experience.

A smart decision unlocks new, high-value customer segments and drives measurable growth. A misstep can burn through capital and time with little to show for it.

This guide moves beyond a simple pros-and-cons list. We'll analyze both marketplaces through RedDog’s Foundation → Optimization → Amplification framework. This proven approach helps you build a profitable, scalable operation from day one, whether you're diversifying from a DTC site or scaling an existing marketplace business.

Before we dive into the strategic details, this table provides a high-level snapshot of how these two retail behemoths compare. Use this to get grounded in the core differences.

| Attribute | Amazon | Walmart Marketplace |

|---|---|---|

| Audience Size | Over 2.8 billion monthly visits | Over 400 million monthly visits |

| Seller Competition | Extremely high (over 1.9M active sellers) | Lower (around 150,000 active sellers) |

| Monthly Fee | $39.99 (Professional Plan) | $0 (No monthly subscription fee) |

| Fulfillment Service | Fulfillment by Amazon (FBA) | Walmart Fulfillment Services (WFS) |

| Onboarding Process | Open registration, generally quick | Selective application, requires approval |

| Primary Customer | Prime members, broad demographics | Value-focused, strong in grocery/essentials |

The differences are clear. Each platform is built to serve a different type of seller and supports distinct stages of brand growth.

The question isn't "Which marketplace is better?" but "Which marketplace is the right strategic fit for my business model and growth stage?" A DTC brand might leverage Walmart's lower competition for faster market penetration, while a large distributor might require Amazon’s massive fulfillment network to manage its extensive catalog.

Of course, a true omnichannel strategy doesn't stop at Amazon and Walmart. Resilient brands eventually build strategies for reaching customers beyond the marketplace to create a diversified, risk-proof business. For now, let’s focus on mastering these two giants.

Before building a winning omnichannel strategy, you must understand who you're selling to. When comparing Walmart Marketplace and Amazon, the obvious difference is audience size. But the real story—and your strategic advantage—lies in the unique characteristics of each customer base.

Amazon is the undisputed king of e-commerce traffic. It’s more than a retail site; it's the default product search engine for most consumers, pulling in a massive global audience with high purchase intent. This scale offers brands incredible visibility from day one.

Walmart’s online presence, while smaller, is growing rapidly. Its strength is rooted in a different kind of loyalty—one built on its massive brick-and-mortar footprint. The Walmart shopper is a value-conscious consumer who seamlessly blends their online and in-store shopping experiences.

The data confirms Amazon’s dominance. It commands a staggering 38% of the US e-commerce market, dwarfing Walmart's 6.4%.

This market share translates into immense traffic, with Amazon attracting around 2.82 billion visits monthly. For brands, this level of exposure is a powerful advantage, but it’s a double-edged sword that brings intense, global competition.

Amazon's ecosystem is powered by its 200 million+ Prime subscribers worldwide. This isn't just a customer list; it’s a massive base of high-intent buyers conditioned to expect fast, free shipping. This dynamic makes Fulfillment by Amazon (FBA) a near-essential tool for any brand aiming to compete effectively.

The sheer scale of Amazon means there's an audience for virtually any product. The challenge isn't finding customers; it's achieving visibility among millions of sellers vying for the same attention. A crystal-clear brand strategy is non-negotiable. If you're weighing the opportunity, our guide on whether it is worth selling on Amazon offers a deeper analysis.

While Walmart’s online traffic is smaller than Amazon's, its true power lies in its unparalleled physical retail footprint. Walmart strategically leverages its 4,600+ US stores as fulfillment centers, distribution hubs, and local connection points for its online customers.

This integration of digital and physical retail creates a unique and valuable consumer: the omnichannel shopper. These are customers who value the convenience of online ordering but also want the instant gratification of in-store pickup and hassle-free returns.

For brands, this creates an opportunity to reach a different kind of consumer—one who is loyal to the Walmart brand and values the unique blend of online convenience and offline accessibility.

Choosing a marketplace is about more than traffic—it's about the daily reality of managing your business on the platform. Your onboarding experience sets the stage for your operational efficiency and speed to market. This is the first step in building your marketplace Foundation, a core pillar of RedDog’s growth framework.

Amazon’s seller experience is mature and feature-rich, but it can also be rigid and unforgiving. In contrast, Walmart is cultivating a more seller-centric environment that feels like a partnership, offering a smoother on-ramp for brands seeking to diversify their sales channels.

Amazon Seller Central operates as an open-door marketplace. For $39.99 per month, virtually anyone can create a Professional Seller account through a largely automated process. This low barrier to entry is the reason for its massive seller base, but it's also the source of its greatest challenge: you are immediately dropped into a hyper-competitive environment.

Getting started is one thing; navigating the platform is another. Amazon’s rules are strict and enforced by algorithms. A minor mistake can trigger automated warnings or account suspensions with little human oversight, creating a steep and costly learning curve for new sellers.

Walmart Marketplace is playing a different game by prioritizing seller quality over quantity. Its application process is more selective, requiring sellers to demonstrate they are an established business with a proven sales history and reliable fulfillment capabilities. This curation creates a more professional and significantly less saturated marketplace.

Walmart's growth is impressive: the marketplace now has over 160,000 active sellers, a 40% year-over-year increase. Unlike the cutthroat feel of Amazon, Walmart offers a less crowded playing field and a faster onboarding process, often taking less than two weeks for US-based businesses. A major benefit is the absence of monthly subscription fees.

Strategic Takeaway: View Walmart’s selective onboarding not as a barrier, but as a competitive advantage. Once approved, you share the digital shelf with fewer, more reputable sellers. This makes it easier to gain visibility and win the Buy Box without relying on a massive ad budget.

This supportive environment makes Walmart an excellent launchpad for brands building an omnichannel presence. The process is a key part of our complete guide on how to sell on Walmart Marketplace, which breaks down every step for a successful launch. A smoother start on Walmart allows you to establish a solid operational foundation before scaling into more competitive arenas.

Profitability isn't driven by sales volume alone—it's determined by what you keep after all fees are paid and every order is shipped. When evaluating Walmart Marketplace vs. Amazon, a deep dive into the complex web of operational costs is essential for building a sustainable business. This is where you Optimize your strategy to protect margins.

Both Amazon and Walmart charge referral fees—a percentage of the total sale price, typically ranging from 8% to 15% depending on the product category. While these base fees are comparable, the platforms diverge significantly on monthly subscriptions, fulfillment charges, and storage fees.

The most immediate difference is the monthly subscription. Amazon charges Professional sellers a flat $39.99 per month. This fixed cost must be factored into your budget from day one and provides access to its full suite of seller tools and FBA eligibility.

Walmart, in contrast, charges no monthly subscription fees. This makes it a more accessible entry point for brands testing the marketplace or for sellers with smaller catalogs who need to minimize recurring overhead. For any business focused on lean operations, Walmart holds a clear advantage here.

Fulfillment is one of the largest variables in your operational budget. Amazon's Fulfillment by Amazon (FBA) and Walmart Fulfillment Services (WFS) both offer end-to-end logistics, but their distinct fee structures can significantly impact your bottom line.

Comparing these marketplaces also means understanding the logistics behind the scenes. Grasping concepts like designing efficient e-commerce fulfillment centers for speed and accuracy provides insight into how these giants manage their massive fulfillment networks. WFS was clearly built to compete with FBA on both price and service, giving sellers a viable and cost-effective alternative.

Beyond direct fees, certain platform policies create hidden costs. Amazon’s Inventory Performance Index (IPI) score is a prime example. This metric grades your FBA inventory management, and a low score can lead to storage limits and higher fees. This forces sellers into costly inventory removals or aggressive discounting simply to avoid penalties.

For many brands, Amazon's IPI score creates a significant operational burden. It pressures you to maintain high sell-through rates, which is challenging for seasonal products or items with fluctuating demand. WFS, being newer, currently has more lenient inventory requirements, giving sellers greater operational flexibility.

This operational difference is critical. Amazon demands sophisticated, data-driven inventory planning. Walmart, for now, provides a more forgiving environment, allowing you to focus on sales rather than punitive performance metrics as you scale. This alone can make WFS a lower-risk choice for brands still optimizing their supply chain.

Visibility on a crowded digital shelf is never accidental—it's earned through strategic advertising. This is the Amplification stage of our growth framework, where a solid foundation is converted into measurable sales velocity. When comparing Walmart Marketplace vs. Amazon, the differences between their ad platforms reflect each company's market maturity and strategic focus.

Amazon Advertising is a highly sophisticated ecosystem, refined over years into a powerful, data-rich tool for brands. Walmart Connect is the newer, less complex challenger that is evolving quickly and offers a compelling advantage for sellers seeking efficiency and lower costs in a less competitive landscape.

Amazon provides a comprehensive suite of advertising tools that enable granular targeting. As both a retail and search platform, Amazon possesses unparalleled shopper data, allowing brands to reach customers at every stage of the buying journey.

The primary ad types include:

This mature system offers immense control, but it comes at a cost. Intense competition means Cost-Per-Click (CPC) rates are often significantly higher than on Walmart. However, the powerful analytics and targeting capabilities can deliver a strong Return on Ad Spend (ROAS) for well-managed campaigns. To learn more, explore our in-depth guide to Amazon Ads management.

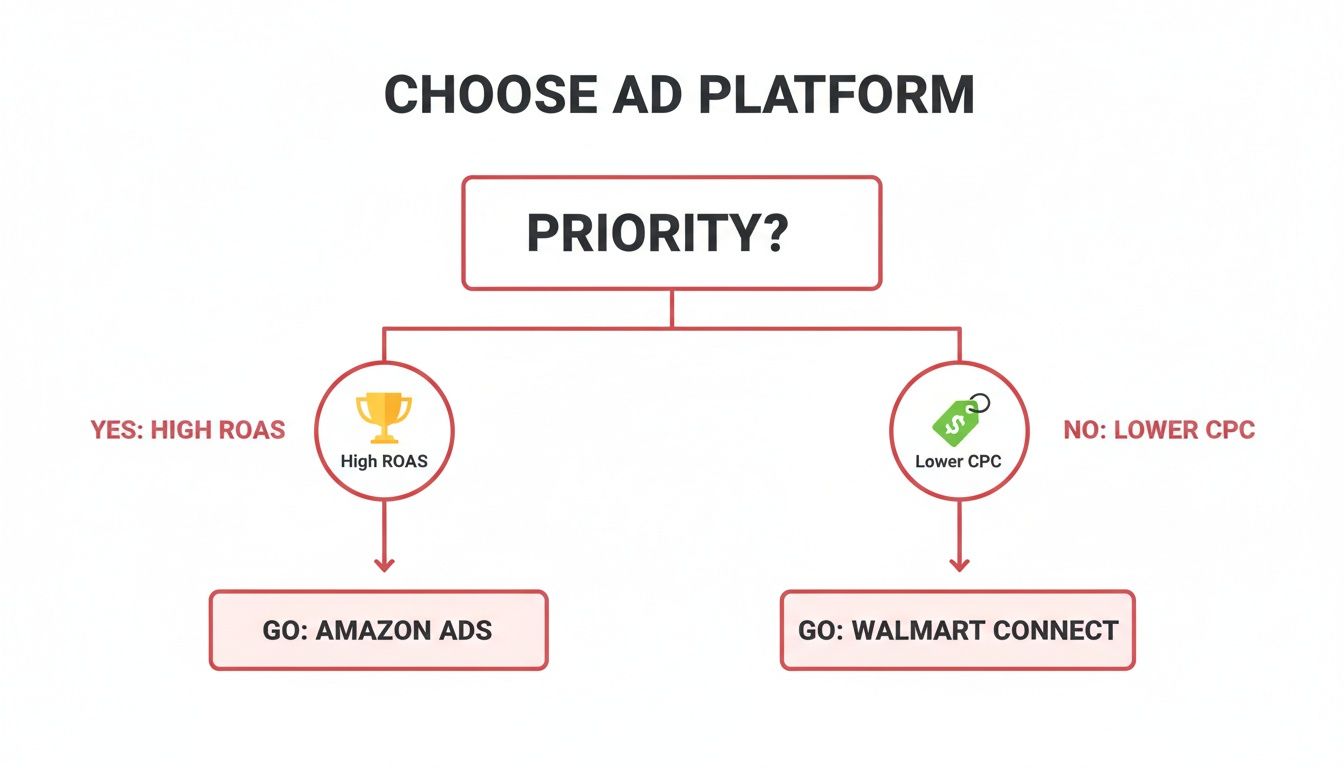

Walmart Connect is the challenger, built to leverage Walmart’s massive omnichannel footprint. While its toolset is more streamlined than Amazon's, it offers a crucial advantage: lower competition. With fewer sellers bidding on keywords, CPCs are generally more affordable, allowing for greater budget efficiency.

This infographic simplifies the core decision between the two platforms based on your primary advertising goal.

The key insight is clear: brands prioritizing immediate budget efficiency often find Walmart to be a better starting point, while those with larger budgets chasing maximum return leverage Amazon's advanced tools.

Here’s a quick side-by-side comparison of what each platform offers advertisers.

| Feature | Amazon Advertising | Walmart Connect |

|---|---|---|

| Primary Ad Types | Sponsored Products, Brands, Display | Sponsored Products, Sponsored Brands |

| Targeting Options | Keyword, product (ASIN), category, audience, remarketing | Keyword (auto & manual), product, placement |

| Competition Level | Very High | Low to Moderate |

| Average CPC | Higher | Lower |

| Key Differentiator | Deep search behavior data, advanced analytics | Omnichannel data (in-store + online), lower cost entry |

This table illustrates the trade-offs: Amazon offers depth and precision at a higher cost, while Walmart provides a more direct, cost-effective path to visibility.

A key differentiator for Walmart Connect is its access to unique in-store purchase data. This enables brands to target online ads to customers based on their physical Walmart purchases—a powerful tool for CPG brands aiming to integrate their retail and digital strategies.

Due to lower competition, sellers on Walmart can often achieve prominent ad placements and gain market share more quickly and with a smaller budget. This makes it an ideal platform for brands looking to establish a strong presence without engaging in a costly bidding war. The key is to act now while the landscape remains relatively open.

There is no universal winner in the Walmart Marketplace vs. Amazon debate. The "best" platform is the one that aligns with your products, operational maturity, and long-term growth objectives. This is a strategic decision about market entry, not just a feature comparison.

The right choice depends on your business model. Are you a high-growth DTC brand, an established CPG player, or a seasoned Amazon seller looking to diversify? Each profile has a distinct path to success.

For direct-to-consumer brands with a loyal following, Walmart Marketplace serves as an excellent, low-noise customer acquisition channel. The selective seller approval process means you aren't immediately fighting thousands of competitors for visibility. Your established brand equity can shine through and drive meaningful results.

Strategic Takeaway: View Walmart not as a replacement for your DTC site, but as a strategic extension into a new, value-conscious demographic. The lower ad costs on Walmart Connect allow you to amplify your reach and acquire new customers without depleting your marketing budget.

If you're in consumer-packaged goods (CPG)—especially groceries or everyday essentials—a presence on Walmart Marketplace is non-negotiable. Its dominance in the US online grocery market is a strategic advantage you cannot afford to ignore.

Data shows Walmart commands a 32% US market share in online grocery, significantly ahead of Amazon's 22.6%. This lead is powered by its massive store network, enabling fast fulfillment and attracting shoppers who prioritize convenience. For CPG brands, this is the perfect environment for a "shelf-to-screen" strategy that connects your in-store presence with powerful online advertising. You can find more data on Walmart's grocery market strength on incrementumdigital.com.

For brands that built their business on Amazon, expanding to Walmart Marketplace is a critical diversification strategy. Over-reliance on a single channel leaves you vulnerable to algorithm changes, fee increases, and policy updates. Adding Walmart provides an insurance policy and opens up a new stream of incremental revenue.

An Amazon-native seller already possesses the playbook for marketplace success. You can apply your expertise in listing optimization, inventory management, and PPC advertising to a less competitive field, often leading to faster traction and a higher return on your initial investment.

Ultimately, the goal is to build a resilient, multi-channel retail business. Whether you are setting your Foundation on a new platform, Optimizing your operations, or Amplifying your brand to new audiences, the right marketplace choice is the launchpad for real, sustainable growth.

When evaluating Walmart Marketplace against Amazon, several key questions consistently arise. Here are the straightforward answers to help you make an informed decision.

Yes, but with critical caveats. You can use Amazon’s Multi-Channel Fulfillment (MCF) to ship Walmart orders from your FBA inventory. However, Walmart strictly prohibits orders from arriving in Amazon-branded packaging.

To comply with this policy, you must enable two key settings in your MCF account:

Fortunately, Amazon is currently waiving the 5% surcharge for blocking its logistics until early 2027, making MCF an affordable solution for managing a single inventory pool across both channels for now.

Profit margins are influenced more by your product category and operational efficiency than by the platform itself. While Amazon’s massive traffic can drive higher sales volume, the intense competition and high ad costs can quickly erode profits. Many sellers find themselves in a price war just to win the Buy Box.

Conversely, Walmart can offer healthier margins, particularly for new sellers, for two main reasons:

Ultimately, a well-run brand with a smart pricing strategy can be profitable on either marketplace. However, for sellers just starting out, Walmart currently offers a more direct path to profitability.

Getting started on Amazon is significantly easier. Its marketplace is open to almost anyone, and the Professional Seller account setup is a largely automated and straightforward process.

Walmart operates a curated marketplace with a different set of rules. You must apply and be approved, and Walmart will evaluate your business history, operational capabilities, and overall legitimacy. While this makes it more challenging to get on the platform, it also means you enter a less crowded, higher-quality selling environment upon approval.

Think of it this way: Amazon's door is wide open, leading to a crowded room. Walmart's door is selective, leading to a space with more room to grow.

Choosing between Walmart Marketplace and Amazon is a pivotal step in scaling your brand. At RedDog Group, we specialize in transforming these strategic decisions into measurable growth. Our Foundation → Optimization → Amplification framework is designed to help your brand expand profitably on any channel you choose.

1500 Hadley St. #211

Houston, Texas 77001

growth@reddog.group

(713) 570-6068

Amazon

Walmart

Target

NewEgg

Shopify

Leave a comment: