How to Reduce Customer Acquisition Cost: An Omnichannel Growth Guide

Posted on

With ad costs rising, brand margins are getting squeezed. That's why understanding how to reduce customer acquisition cost (CAC) has shifted from a best practice to a core survival skill. The solution isn’t just to cut spending—it’s to strategically optimize your entire growth engine, from ad creative and landing pages to the post-purchase experience.

This approach builds sustainable, profitable growth, moving beyond the expensive cycle of simply buying more ads and hoping for the best.

Your Omnichannel Blueprint for Lowering CAC

High customer acquisition cost is often a symptom of a deeper issue: a disconnect in your growth strategy. It could be inefficient ad spend, a clunky customer journey that bleeds conversions, or a retention strategy that fails to create repeat buyers. Simply increasing your ad budget is a short-term fix that quickly becomes unsustainable.

The path to profitable scale is a structured, measurable approach that makes every marketing dollar work harder. This guide is a practical, omnichannel playbook designed to systematically lower your CAC while scaling your brand across DTC channels like Shopify and marketplaces like Amazon.

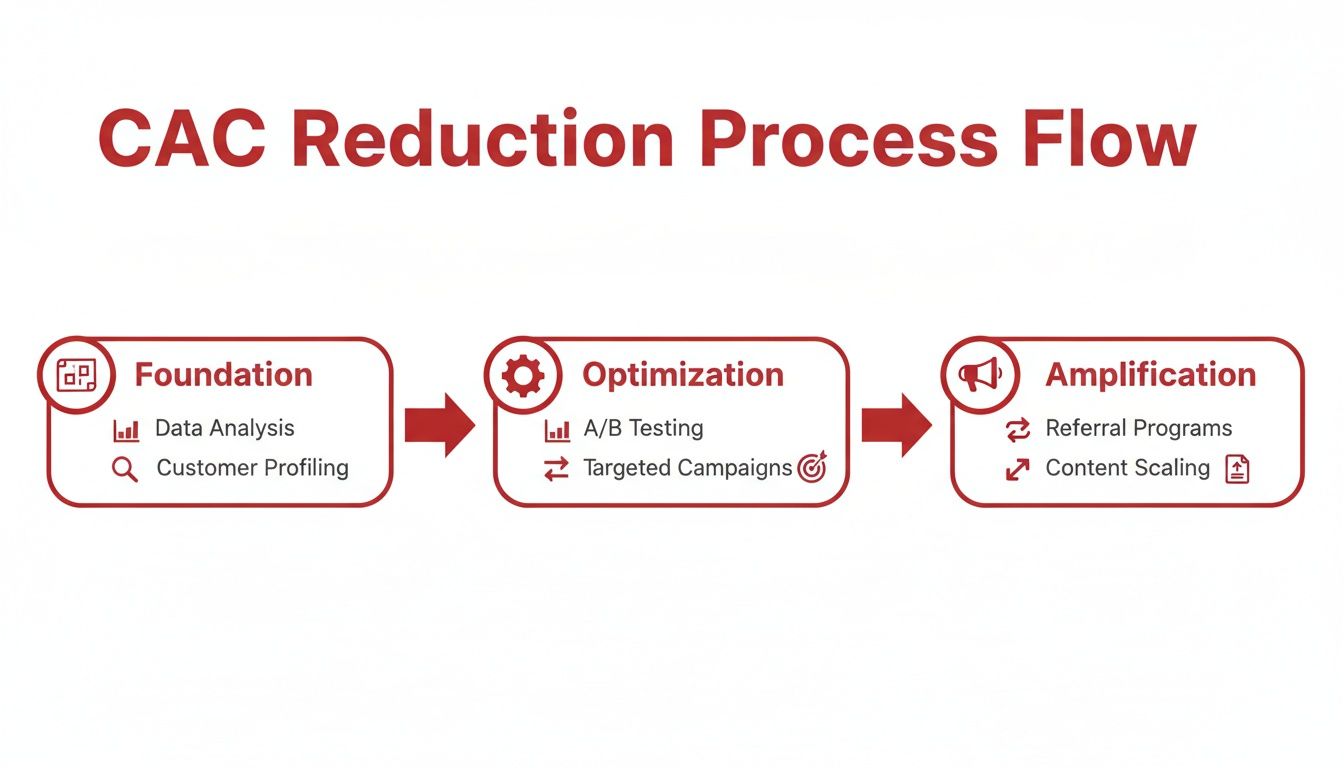

The Foundation → Optimization → Amplification Framework

At RedDog Group, we build growth strategies around three integrated pillars. This framework provides a repeatable process for driving measurable results and moving beyond disconnected tactics.

- Foundation: Get the fundamentals right. This means accurately measuring your true, channel-specific CAC and understanding its relationship to your Customer Lifetime Value (LTV). Without this data clarity, you're operating blind.

- Optimization: With a solid foundation, we diagnose the root causes of high costs. Here, we implement targeted improvements—from refining ad audiences and optimizing landing pages to streamlining the checkout flow—all designed to boost conversion rates.

- Amplification: The final stage scales what works. We focus on transforming repeat buyers into a predictable revenue stream and building a continuous experimentation loop to unlock new efficiencies and growth opportunities.

This flowchart shows how the three pillars work together to drive down customer acquisition costs in a continuous cycle.

As you can see, each stage builds on the last, creating a powerful cycle of continuous improvement. This blueprint is your starting point, but for an even deeper dive into the tactics, check out our comprehensive guide on reducing customer acquisition cost and accelerating your growth.

High-Impact Strategies to Lower Your CAC Now

To get you started, this table summarizes effective tactics you can implement right away for tangible results across your most important online and offline channels.

| Strategy Area | Actionable Tactic | Expected Impact |

|---|---|---|

| Paid Ads (PPC) | Refine ad targeting to focus on high-intent lookalike audiences. | Lower cost-per-click (CPC) and higher conversion rates. |

| Website & Funnel | A/B test your landing page headlines and calls-to-action (CTAs). | Improved on-page conversion and reduced bounce rates. |

| Organic (SEO) | Create long-form content targeting bottom-of-funnel keywords. | Attract qualified, ready-to-buy traffic with zero ad spend. |

| Customer Retention | Launch a simple email campaign to win back lapsed customers. | Reactivate past buyers for a fraction of the cost of new ones. |

| Marketplaces | Optimize your product listings on Amazon/Walmart with better images and copy. | Increased click-through rates and organic ranking. |

Putting even one or two of these strategies into motion can start moving the needle. The key is to test, measure, and double down on what works for your specific audience and products.

Defining and Measuring Your True CAC

To lower your customer acquisition cost, you must first know what it actually is. Many brands make the mistake of using a blended, oversimplified CAC that averages costs across all channels. This practice is dangerous because it masks underperforming channels and hides your most profitable growth opportunities, making data-driven decisions impossible.

You can't improve what you don't measure accurately. This foundational step is about moving past vanity metrics to calculate your true, channel-specific CAC. Before cutting costs, you need a clear understanding of what a Customer Acquisition Cost (CAC) explained is, including all its components.

Beyond Just Ad Spend

Your total acquisition cost is more than just what you pay Google or Meta. A true calculation includes every expense tied to acquiring a customer through a specific channel.

Think bigger than the ad platform invoice. Your true costs include:

- Total Ad Spend: The direct cost of your campaigns on a given platform.

- Salaries & Fees: A portion of your marketing team’s salaries or the full cost of agency retainers.

- Software & Tools: The cost of analytics software, creative tools, or marketing automation platforms.

- Creative Development: Expenses for producing ad creative, like video production or graphic design.

Sum these costs for a set period (e.g., one quarter) and divide by the number of new customers acquired in that same timeframe. That’s how you get a true picture of your costs and performance.

Key Takeaway: A blended CAC hides the truth. If your Meta ads are costing you $150 per customer but your Google Ads only cost $50, a blended average of $100 tells you nothing useful. You need to know which channel is a high-performer and which is draining your budget.

The LTV to CAC Ratio: The Gold Standard for Growth

Measuring CAC in a vacuum is pointless. The crucial next step is to compare it against your Customer Lifetime Value (LTV)—the total revenue you can expect from a single customer over their entire relationship with your brand.

The relationship between these two numbers, the LTV-to-CAC ratio, is the ultimate health check for your marketing efficiency and long-term profitability.

A healthy, sustainable business typically aims for an LTV-to-CAC ratio of 3:1 or higher. This means for every dollar you spend acquiring a customer, you generate at least three dollars in revenue over their lifetime. A 1:1 ratio indicates you're breaking even at best and likely losing money once other business costs are factored in.

Getting this ratio right tells you exactly how much you can afford to spend on acquisition. For a more detailed breakdown of how ad performance impacts overall profitability, you can learn more about how to calculate return on ad spend.

Real-World Example: An Omnichannel Brand

Let’s look at a brand that sells high-end coffee beans on both Amazon and its own Shopify store.

- On Amazon: They spend $10,000 on Sponsored Products ads and acquire 200 new customers. Their Amazon CAC is $50.

- On Shopify: They spend $8,000 on Meta ads, pay a marketing manager $1,500 (pro-rated salary), and $500 on creative, totaling $10,000. They acquire 100 new customers. Their Shopify CAC is $100.

Without this channel-specific breakdown, they might calculate a blended CAC of $66.67 and think things are okay. But the reality is that their DTC channel is twice as expensive to acquire customers through. This insight doesn’t mean they should abandon Shopify; it means they now know exactly where to focus their optimization efforts to improve efficiency and drive profitable growth.

Diagnosing the Root Causes of High CAC

Once you have accurate, channel-specific CAC numbers, you've completed the Foundation phase. Now, the diagnostic work begins.

A high CAC is a symptom, not the disease. Your job is to uncover what’s actually driving costs up. Is it weak audience targeting? Stale ad creative? A confusing landing page experience? Or is your offer out of sync with market expectations?

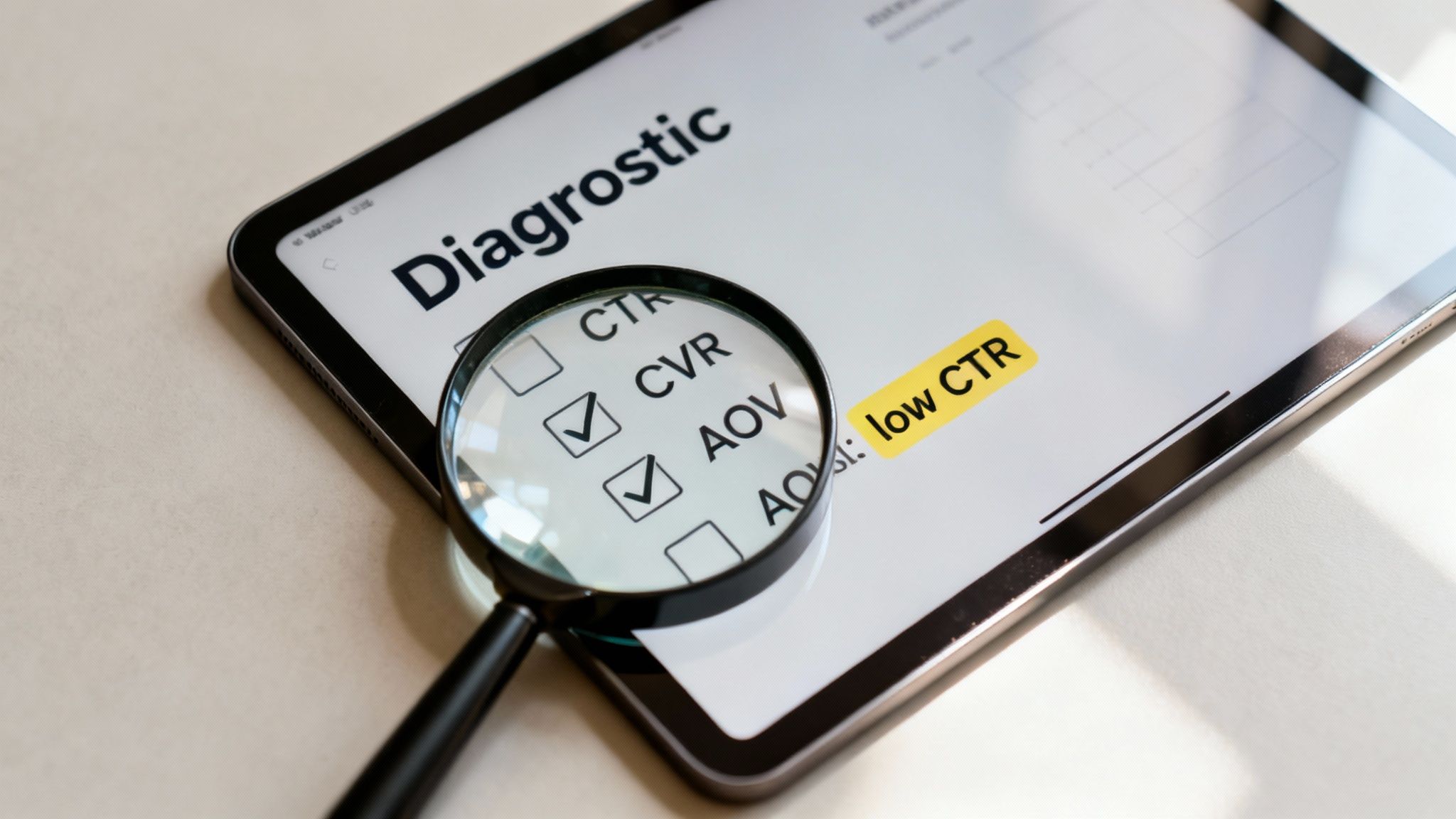

To find the answer, we must shift from a high-level view to a granular analysis of your acquisition funnel. The goal is to identify specific friction points that inflate costs by digging into the key performance indicators (KPIs) that tell the story of your customer's journey.

Your Diagnostic Performance Metrics

To find the weak links in your acquisition chain, focus on three core metrics. Together, these KPIs paint a clear picture of how users interact with your brand, from the first ad impression to the final purchase.

- Click-Through Rate (CTR): This measures the percentage of people who click your ad after seeing it. A low CTR is often the first red flag, signaling a disconnect between your ad and your audience. It could mean your creative is tired, your copy isn't compelling, or your targeting is too broad.

- Conversion Rate (CVR): This is the percentage of visitors who take a desired action—like making a purchase—after landing on your site or product page. If your CTR is strong but your CVR is low, the problem lies further down the funnel. Your ads are getting people in the door, but your landing page is failing to convert them.

- Average Order Value (AOV): This is the average dollar amount a customer spends per transaction. While not a direct measure of acquisition efficiency, a low AOV makes it difficult to maintain a profitable CAC. A higher AOV provides more margin to invest in sustainable ad spend.

Analyzing these three metrics together provides a powerful diagnostic tool. For instance, a declining CTR on Meta ads often points to creative fatigue. A poor CVR on your Shopify product pages might signal a need for better product photography, clearer copy, or more social proof like customer reviews.

The Omnichannel Reality: Problems are rarely isolated to one channel. A low AOV on your DTC site could be caused by a lack of upselling opportunities, while a poor conversion rate on Amazon might be due to negative reviews or slow shipping times. Each channel must be diagnosed on its own terms.

Creating a Practical Diagnostic Checklist

To turn this analysis into action, create a simple checklist to audit each of your channels. This is how you move from a vague problem like "our CAC is high" to a specific, actionable insight like, "our CAC is high because our mobile conversion rate on Google Shopping ads is 50% lower than on desktop."

For each key channel (think Google Ads, Amazon PPC, Meta Ads), ask yourself:

- Audience & Targeting: Are we reaching the right people? Have our lookalike audiences gone stale? Are we wasting budget on irrelevant search terms or demographics?

- Creative & Messaging: Does our ad creative still resonate? Is the message consistent from the ad to the landing page? When was the last time we A/B tested a new hook or visual?

- On-Site Experience: Is the path to purchase smooth and intuitive? How fast does the page load on mobile? Are product images high-quality and descriptions compelling? Is the call-to-action (CTA) clear and prominent?

- Offer & Pricing: Is our offer competitive? Are surprise shipping costs killing conversions at checkout? Does our pricing align with the perceived value of our products?

This structured approach helps you uncover the real issues that need fixing, allowing you to prioritize optimizations that will make a measurable impact on your customer acquisition cost.

Data shows that integrated strategies are crucial. Companies that combine paid search, marketplace ads, and SEO are better able to control CAC growth while competitors see their costs skyrocket. You can dive into more trends on customer acquisition costs to see how a unified approach pays off.

Channel-Specific Tactics to Optimize Your Acquisition Engine

With your diagnosis complete, it’s time to take action. This is the Optimization phase, where we implement targeted, channel-specific tactics to fix leaks, boost efficiency, and get more value from every dollar spent.

The goal here is simple: make every marketing dollar work harder. Whether you're driving sales on Amazon, investing in Google Ads, or building your brand’s organic presence, there are always efficiencies to be found.

However, generic advice is ineffective. A strategy that delivers results on Amazon PPC may not work on Meta. Reducing CAC requires a nuanced approach that respects the unique rules and user behaviors of each platform.

Winning on Marketplaces Like Amazon and Walmart

For many brands, marketplaces are a primary acquisition engine—but they can also become a major cost center without precise management. The key to winning is balancing paid advertising with a relentless focus on organic visibility.

First, your product detail pages (PDPs) must be conversion machines. This is about strategic merchandising, not just pretty pictures. Use high-quality lifestyle images and infographics that answer customer questions before they're asked. Your copy should be packed with relevant keywords while clearly communicating benefits, not just listing features.

Next, get smarter with your PPC campaigns. Stop wasting money on broad, expensive keywords. Dive into your analytics—tools like Amazon's Brand Analytics are invaluable—to uncover long-tail keywords and competitor terms that signal high purchase intent.

For example, a CPG brand selling coffee can use Amazon’s Search Query Performance report and discover customers are searching for "low-acid dark roast for sensitive stomach." Instead of bidding on the hyper-competitive term "dark roast coffee," they can create a specific campaign targeting this niche query. The result? A much higher conversion rate at a fraction of the cost.

Actionable Takeaway: Treat your marketplace listings like dynamic assets. Continuously test new images, bullet points, and A+ Content. Even small, iterative improvements to your conversion rate have a massive downstream effect on lowering ad costs and boosting organic rank.

Refining Paid Channels Like Google and Meta

Paid social and search are often the largest marketing expenses, making them critical areas for CAC optimization. The name of the game is eliminating wasted spend by tightening targeting and refreshing creative.

On platforms like Meta, ad fatigue is your enemy. Running the same ad for too long will cause click-through rates to plummet and costs to skyrocket. Implement a structured A/B testing process for creative, constantly iterating on hooks, visuals, and CTAs to discover what truly drives action.

For Google Ads, it's all about intent. Are you reaching users who are just browsing or those who are ready to buy?

- Negative Keywords: Be ruthless with your negative keyword lists. If you sell premium leather boots, you don't want to pay for clicks from people searching for "cheap vegan boots."

- Audience Layering: Don't just rely on keywords. Layer on audiences, such as in-market segments or your own first-party data, to show ads only to the most qualified searchers.

- Performance Max Campaigns: Use these strategically, not as a "set it and forget it" tool. Feed them strong creative assets and robust audience signals to guide the algorithm, and closely monitor asset group performance to cut what isn't working.

Structuring campaigns for profitability from the start is non-negotiable. This means setting realistic budgets and using smart bidding strategies like Target CPA (tCPA) to control costs once you have sufficient conversion data. Every dollar saved on an irrelevant click is a direct reduction in your CAC.

To help you prioritize, here's a quick look at the main levers you can pull across different channels.

Channel Optimization Cheat Sheet

A comparative look at key levers for reducing CAC across different marketing channels, helping you prioritize your efforts.

| Channel | Primary Lever for CAC Reduction | Key Metric to Watch |

|---|---|---|

| Marketplaces (Amazon) | PDP Conversion Rate | Unit Session Percentage |

| Paid Search (Google) | Keyword & Audience Targeting | Cost Per Conversion / ROAS |

| Paid Social (Meta) | Ad Creative & Offer | Click-Through Rate (CTR) |

| SEO & Content | High-Intent Keyword Rankings | Organic Traffic & Conversions |

| Email & SMS | Segmentation & Personalization | Campaign Revenue & LTV |

Focusing on these primary levers will give you the biggest bang for your buck when you're trying to drive down costs.

Building Your Organic and Direct Traffic Engine

The lowest possible CAC comes from a customer who finds you organically or seeks you out directly. While SEO and brand building are long-term investments, they are your ultimate defense against rising ad costs.

Your organic strategy should be built around one goal: creating content that answers high-intent questions.

Think about the actual problems your product solves. A skincare brand doesn't just sell moisturizer; they sell solutions for "dry winter skin" or "managing acne-prone combination skin." Creating in-depth blog posts, guides, or video tutorials around these topics attracts qualified buyers who are already searching for what you offer. This approach builds authority and drives traffic that costs $0 per click.

Building a strong brand that people remember and trust also encourages direct traffic—users who type your URL straight into their browser. This is the holy grail of acquisition because it has a $0 CAC. You achieve this through excellent customer service, a memorable brand voice, and a product that consistently delivers on its promise.

Ultimately, each of these channel-specific optimizations feeds into the larger goal of improving your website's overall performance. For a deeper look at on-site improvements, check out our guide on how to improve eCommerce conversion rates for measurable growth.

Turn Repeat Buyers into Your Best CAC Strategy

The most effective way to reduce your customer acquisition cost often has little to do with finding new customers. It’s about focusing on the ones you’ve already acquired. While chasing new buyers is an expensive, endless cycle, a smart retention strategy transforms a one-time acquisition cost into a predictable, long-term revenue stream.

This is the Amplification phase. You already paid to get them in the door; now it's time to make that initial investment work harder. When you drive repeat purchases, you dramatically improve your LTV-to-CAC ratio and make your entire marketing engine more profitable.

Focusing on retention and loyalty effectively spreads that initial acquisition cost over multiple orders. As LoyaltyLion.com explains in their breakdown of how retention impacts CAC, keeping customers coming back is a direct path to healthier margins.

From First Sale to Second and Beyond

The moments immediately following a customer’s first purchase are your best opportunity to secure a second one. A strategic post-purchase flow can turn a simple transaction into a lasting relationship.

Instead of a generic "Thanks for your order" email, build a sequence that adds value and provides a reason to return.

- Welcome & Education: The first email should confirm the order but also welcome them to the brand. Share your story or offer quick tips on how to get the most out of their new product.

- Check-in & Social Proof: A few days later, send a message to see how they're enjoying their purchase. This is the perfect time to include user-generated content or positive reviews to reinforce their decision.

- The Second-Purchase Nudge: About two weeks after their order, present a compelling, time-sensitive offer for their next purchase. This doesn’t have to be a big discount—free shipping or a small gift with their next order can be a powerful nudge to return.

This simple, automated sequence keeps your brand top-of-mind and systematically guides customers toward that crucial second purchase, effectively doubling the value of your initial acquisition spend.

Building Simple, Effective Loyalty Programs

You don’t need a complex points-based system to build loyalty. A simple tiered program that rewards repeat business can be far more effective. The goal is to make your best customers feel valued and give them a clear reason to choose you over a competitor.

For instance, a straightforward "VIP" program could offer perks like:

- Early access to new products.

- Exclusive access to limited-edition items.

- Free shipping on all future orders after their third purchase.

Real-World Example: A subscription snack box brand noticed a significant drop-off after the third month. They implemented a simple feedback loop asking churning subscribers one question: "What's one snack you wish we had?" After adding the top three requested items, they sent a targeted "We heard you!" email to those former customers. This simple act of listening slashed their churn by 15% and reactivated hundreds of subscribers, amplifying the value of their original acquisition spend.

This approach transforms retention from a defensive tactic into a core growth strategy. For a deeper dive, our guide offers five proven tactics to increase customer lifetime value. By focusing on the customers you already have, you build a more resilient business that isn't entirely dependent on rising ad costs.

Building a Continuous Improvement Loop

Lowering your customer acquisition cost is not a one-time project; it’s a continuous cycle of testing, learning, and reinvesting in what works. Committing to this process turns small, incremental gains into significant long-term improvements in profitability.

This is where the Amplification part of our framework truly comes to life. It’s about creating a disciplined experimentation loop to consistently test new channels, ad creative, landing pages, and offers.

Structuring Tests for Actionable Data

Smart testing is a disciplined process, not guesswork. Start with a clear hypothesis. For example: "We believe changing our main product photo from a studio shot to a lifestyle shot will increase our add-to-cart rate by 10% because it helps customers visualize using the product."

This structure gives your A/B test a clear purpose and a measurable definition of success. Run one test at a time per element to ensure your data is clean and your results are conclusive.

Your next big growth lever isn't just about finding a new channel. It's about embedding a disciplined process of continuous improvement into your team's DNA. That’s the mindset that ensures you're always optimizing and never stagnating.

Reporting on What Matters Most

Your reports should tell a story about profitable growth, not just display vanity metrics. Create a simple dashboard that tracks two key performance indicators over time:

- Channel-Specific CAC: Monitor the cost to acquire a customer for each of your core channels (e.g., Meta, Google, Amazon).

- LTV-to-CAC Ratio: Track this ratio on a rolling 30, 60, and 90-day basis. This shows how your optimization efforts are impacting long-term profitability.

This no-fluff approach keeps your team focused on acquiring customers who are not only cost-effective to acquire but also valuable to retain.

Ready to build a growth engine that gets more efficient over time? Let’s Talk Growth.

Frequently Asked Questions About Reducing CAC

What Is a Good Customer Acquisition Cost?

There’s no single magic number. A "good" CAC is entirely relative to your Customer Lifetime Value (LTV).

The benchmark for sustainable growth is an LTV-to-CAC ratio of at least 3:1. For every dollar you invest in acquiring a customer, you should generate at least three dollars in revenue over their lifetime. If your ratio is near 1:1, you are almost certainly losing money once all business costs are factored in.

Knowing your LTV is critical. Once you understand that metric, you'll know exactly how much you can afford to spend on acquisition while maintaining profitability.

How Often Should I Calculate My CAC?

Establish a rhythm that fits your business, but a solid approach is to calculate CAC monthly and quarterly.

Monthly calculations are for tactical adjustments. They help you quickly optimize ad campaigns, reallocate channel spend, and react to real-time market changes.

Quarterly reviews are for strategic planning. This is where you zoom out to identify broader trends, assess the impact of major initiatives, and set the strategy for the upcoming quarter. This cadence prevents overreacting to minor, daily data fluctuations.

Don't get lost in daily numbers. A monthly and quarterly review provides the ideal balance of tactical agility and strategic oversight, helping you make smarter, data-driven decisions on how to reduce customer acquisition cost.

Which Strategy Has the Fastest Impact on Lowering CAC?

For the quickest wins, focus on the bottom of your funnel. Optimizing your website's conversion rate is almost always the fastest way to see a measurable impact, as it makes the traffic you've already paid for work harder.

A few high-impact actions to take right away include:

- A/B Testing Your Landing Pages: Simple changes to a headline or call-to-action can significantly lift conversion rates. Test key elements methodically.

- Streamlining Your Checkout Process: Remove unnecessary form fields or steps. Every bit of friction you eliminate reduces the chance of cart abandonment.

- Refining Ad Targeting: This is an immediate money-saver. Cut wasted ad spend by tightening your audiences and adding negative keywords to paid search campaigns.

These actions deliver a much faster return than long-term plays like SEO because they directly improve the efficiency of your current marketing spend.

At RedDog Group, we build profitable, omnichannel growth strategies that turn every marketing dollar into measurable results. Ready to get your acquisition costs under control? Let’s Talk Growth.

Leave a comment: