A Brand's Guide on How to Price Products for Retail Effectively

Posted on

Figuring out how to price products for retail always starts with one non-negotiable step: calculating your true landed cost. This isn't just your supplier's invoice; it's the all-in number to get a single unit into your warehouse, ready to sell. This figure is the absolute bedrock of a profitable, scalable brand—it's the Foundation of your entire growth strategy.

Mastering Your True Product Cost and Target Margin

Before you can set a retail price, you need total clarity on what it costs to acquire your product. Many brands make the critical mistake of only looking at the Cost of Goods Sold (COGS) from their manufacturer, ignoring a dozen other expenses that quietly eat away at profits.

This oversight becomes especially damaging in an omnichannel environment. A product that seems profitable on your Shopify store might actually lose you money on Amazon once referral fees and fulfillment costs are factored in. Without a precise landed cost, you’re pricing blind. This is the foundational data you need to build a resilient business.

Calculating Your True Landed Cost

Your true landed cost is the sum of every expense incurred to get one unit from the factory floor to your fulfillment center. It goes far beyond the per-unit price on your supplier's invoice.

To get an accurate number, you must account for every fee along the supply chain. Here’s what to include in your calculation:

- Cost of Goods (COGS): The base price paid to your manufacturer per unit.

- Freight & Shipping: The cost to move inventory from the factory to your warehouse or 3PL.

- Customs & Duties: Taxes and tariffs on imported goods, which can vary significantly.

- Insurance: Coverage for your products while in transit.

- Inbound & Receiving Fees: Charges from your warehouse for unloading and stocking inventory.

- Packaging & Prep: The cost of any custom boxes, labels, or poly bags required.

Here’s a simple template to ensure you capture everything. The goal is a single, all-in number representing your real cost per unit before it’s ready to be sold.

Landed Cost Calculation Breakdown

| Cost Component | Example Calculation (Per Unit) | Why It Matters for Pricing |

|---|---|---|

| Cost of Goods Sold (COGS) | $5.00 | The starting point for all cost calculations. |

| Freight & Shipping | $1.50 | Often a significant expense that erodes margins if ignored. |

| Customs & Duties | $0.50 | A variable but mandatory cost that directly impacts your base cost. |

| Insurance | $0.10 | A small but necessary cost to protect your investment. |

| Inbound & Receiving Fees | $0.15 | Warehouse fees that add up, especially for large shipments. |

| Packaging & Prep | $0.25 | The cost of making your product retail-ready before it ships. |

| Total Landed Cost | $7.50 | This is your true cost and the foundation for all pricing. |

Let's look at a real-world example. A brand sells a premium water bottle with a factory cost of $5.00. A common mistake is to simply double this for a $10.00 wholesale price. But after adding $1.50 for freight, $0.50 for duties, and $0.25 for 3PL receiving fees, the true landed cost is actually $7.25. That seemingly small $2.25 difference completely changes your profitability on every single channel.

Key Takeaway: Miscalculating your landed cost is one of the fastest ways to destroy your margins. Every pricing decision must start from this all-inclusive number, not just the factory cost. This is your brand's financial foundation.

Setting a Sustainable Target Margin

Once your landed cost is locked in, the next step is to define your target gross margin. This isn’t a random number; it's a strategic decision that determines your brand’s capacity for growth, marketing spend, and overall financial health.

Your target margin must be robust enough to cover all operating expenses—like marketing, salaries, and software—and still leave a healthy net profit. A common benchmark for consumer goods is a gross margin between 40% and 60%, but this can shift based on your industry and business model.

To calculate your target price based on margin, use this simple formula:

Target Price = Landed Cost / (1 - Target Margin Percentage)

Using our water bottle example with a $7.25 landed cost and a target margin of 50% (0.50):

- Target Wholesale Price = $7.25 / (1 - 0.50) = $14.50

This calculation ensures that for every unit sold at wholesale, you retain 50% of the revenue to cover operations and turn a profit. This data-driven approach removes guesswork and builds a solid financial foundation. Once you nail these fundamentals, you can explore more advanced strategies. Our guide on why pricing strategies matter offers deeper insights into building a resilient framework.

Building Your Pricing Architecture with MSRP and MAP

Once you’ve established your true landed cost and target margin, you have the financial foundation of your pricing strategy. Now it’s time to move from internal spreadsheets to a public-facing game plan. This is where you build a pricing architecture that not only generates profit but actively defends your brand’s value across every sales channel.

This isn’t about just putting a price on a product. It’s about creating a framework that maintains consistency, supports your retail partners, and prevents brand degradation. The two pillars of this structure are the Manufacturer’s Suggested Retail Price (MSRP) and the Minimum Advertised Price (MAP).

Setting the Standard with MSRP

The MSRP is the price you recommend retailers sell your product for. Think of it as the official "sticker price" a customer sees on your website or a store shelf. Setting the right MSRP is your first move in positioning your brand in the market. It’s a powerful signal, telling consumers and retail buyers what your product is worth.

A well-calculated MSRP needs to accomplish three things:

- Reflect Your Brand's Value: The price should align with your product's quality, innovation, and unique selling proposition.

- Provide Retailer Margin: It must be high enough to allow your wholesale partners to achieve a healthy profit after buying from you.

- Anchor Customer Perception: The MSRP acts as a psychological benchmark, making any promotional price feel like a genuine deal.

For example, if your water bottle has a wholesale price of $14.50, a standard keystone markup would place the MSRP at $29.00. This gives retailers a solid 50% margin and establishes a clear, consistent value for your product in the customer's mind.

Protecting Your Brand with a MAP Policy

While the MSRP is a suggestion, a MAP policy is a formal agreement between you and your retailers. It sets the absolute lowest price they can advertise your product for, whether online or in a print ad. It doesn't control the final in-cart price, but it’s your best defense against public price wars that can destroy a brand's reputation.

A solid MAP policy is non-negotiable in today’s omnichannel marketplace. Without one, you’re inviting a "race to the bottom," where third-party sellers on marketplaces like Amazon or Walmart constantly undercut each other. When a shopper sees your product advertised for $29 one day and $19 the next, they begin to question its true worth.

Key Insight: A MAP policy isn’t about price fixing; it’s about brand perception management. It ensures your product is presented consistently across all channels, building consumer trust and protecting the investment your best retail partners have made in your brand.

Rolling out an effective MAP policy requires clear communication and consistent enforcement. Your policy should specify the minimum advertised prices for each SKU and the consequences for violations—such as pausing shipments or terminating the partnership. This levels the playing field for all retailers, from small boutiques to major chains, and protects your own DTC channel from being unfairly undercut. This structure is a core part of the Optimization phase, where your foundational numbers become a real, scalable market strategy.

Adapting Your Pricing for an Omnichannel World

A one-size-fits-all price tag is a relic of the past. Your customers shop everywhere—your website, Amazon, big-box retail stores—and a rigid pricing structure that ignores the unique costs of each channel is a surefire way to damage profitability.

This is the Optimization phase of our framework. We're moving beyond a single, foundational price and into a dynamic strategy that adapts to where you sell.

The price on your Shopify store simply can't be the same as your Amazon FBA price, and neither can match the wholesale price you offer a key retail partner. Each channel is its own ecosystem with different fees, customer expectations, and competitive pressures. Your job is to price your products to win in each one while maintaining brand integrity.

Deconstructing Channel-Specific Costs

Before setting a smart price, you must be brutally honest about the cost of selling on each platform. These aren't minor fees; they are significant expenses that will erode your margins if not accounted for. Ignore them, and you could be losing money on every sale in a channel you believe is performing well.

Here’s a practical breakdown of the costs:

- Direct-to-Consumer (DTC) on Shopify: Your major costs here are customer acquisition and fulfillment. This includes payment processing fees (typically around 2.9% + 30¢), ad spend on platforms like Google and Meta, and the actual cost to pick, pack, and ship orders.

- Amazon FBA: This marketplace is known for its complex fee structure. You'll face referral fees (typically 15%), FBA fulfillment fees that vary by size and weight, potential long-term storage fees, and the advertising costs required to gain visibility.

- Wholesale to Retail Partners: The primary "cost" here is the deep discount you provide your retail partner. A standard keystone margin is 50%, meaning a retailer buys your $30 product for $15. Your wholesale price must be low enough for them to be profitable, but high enough for you to maintain a healthy margin.

Failing to map these costs by channel is a recipe for disaster. It leads to inconsistent profits and can create channel conflict that damages your retail partnerships.

Building a Flexible Omnichannel Pricing Model

The goal is to build a pricing model that maximizes profit and sales volume across all channels without letting one cannibalize another. This means using your direct-to-consumer price—your MSRP—as the anchor for everything else.

Let’s walk through a real-world example for a skincare brand with a serum that has a $10 landed cost and a $40 MSRP.

- DTC (Shopify): They sell direct at the $40 MSRP. This is their highest-margin channel, perhaps netting a 60% margin after marketing and fulfillment. It serves as their profit engine.

- Wholesale: A large retailer receives a 50% discount, buying the serum for $20. The brand’s margin is lower, but high-volume orders generate predictable cash flow and introduce the product to thousands of new customers.

- Amazon FBA: To avoid undercutting retail partners (and their own site), they list the serum for $40 on Amazon. After Amazon's 15% referral fee ($6) and FBA fees ($5), their net revenue is $29. This leaves a $19 gross profit. The margin is lower than DTC but still better than wholesale.

Key Takeaway: A smart omnichannel strategy doesn't mean having the same price everywhere. It means having a justified price everywhere, with each channel's unique costs and strategic purpose baked into the final number.

This structured approach prevents the common problem of your Amazon price undercutting your own website sales, an issue we cover in our guide to managing price matching on Amazon.

The retail landscape has evolved. Data from a recent global pricing study shows a major gap between pricing strategy and market reality. The average price realization rate has fallen by 5 percentage points to just 43%, while 64% of companies are facing increased pressure from low-price competitors.

By building channel-specific pricing tiers, you ensure every sale—no matter where it happens—is a profitable one. This is how you move from just selling products to building a scalable, resilient brand.

Validating Prices with Market and Consumer Data

A pricing strategy developed in a bubble is doomed to fail. Once you’ve calculated your landed costs, margins, and channel-specific markups, you have a solid internal framework. But the most critical part comes next: testing that framework against the real world. This is where you pivot from spreadsheets and theory to validated, data-driven decisions that actually drive growth.

This process isn't about blindly copying competitors or joining a race to the bottom. It’s about gathering the right intelligence to confirm your product is positioned to win. This boils down to two key activities: practical competitive analysis and understanding your own price elasticity.

Conducting Practical Competitive Analysis

Monitoring competitor pricing is non-negotiable, but it must be done with purpose. The goal is to map the pricing landscape and determine your brand’s rightful place within it—not to reactively match every price drop.

Focus on a few critical data points for clarity:

- Benchmark Your True Competitors: Pinpoint your top three to five direct competitors—brands pursuing the same customer with a product of similar quality.

- Track MSRP vs. Promotions: Note their standard retail price (MSRP) and, more importantly, the frequency and depth of their promotions. Do they protect their price, or are they constantly on sale?

- Analyze Their Value Proposition: Look beyond the price tag. How are they justifying their cost? Is it through premium materials, a compelling brand story, or unique features? Context is everything.

This intelligence provides a snapshot of perceived value in your category. If your calculations suggest a $40 MSRP, but your closest competitor is priced at $30, your branding, packaging, and marketing must clearly communicate why you're worth the extra $10. Modern tools can automate much of this; digging into digital shelf analytics is an excellent starting point for any brand serious about gaining a competitive edge.

Understanding Price Elasticity

Price elasticity sounds like an academic term, but it's a simple and powerful concept. It measures how much demand for your product shifts when you change its price. If a small price drop causes sales to soar, your product is "elastic." If you can raise the price and sales barely change, it's "inelastic."

Knowing your product's elasticity is a massive advantage. It helps you predict the impact of sales and price adjustments before you make them, protecting both your revenue and brand perception.

Key Takeaway: You don't need a team of economists for this. Simple, controlled experiments on your own DTC channel can provide invaluable data on how your actual customers respond to different price points.

Here are a few practical ways to start gathering this data:

- A/B Test Prices on Your Website: This is the cleanest method. Run a test showing two different prices for the same product to two different groups of visitors. For example, Group A sees $39.99 while Group B sees $44.99. After a set period, compare conversion rates and overall profitability.

- Run Limited-Time Offers (LTOs): Use a flash sale or a weekend promotion to test a lower price point. A "20% Off This Weekend Only" deal can reveal how much a discount stimulates demand without permanently devaluing your product.

- Use Surveys and Customer Feedback: Sometimes, you can just ask. A simple post-purchase survey that includes a question like, "What is the most you would be willing to pay for this product?" can provide valuable directional insights.

To see how this comes together, check out this real-world product pricing optimization case study. Seeing how brands use iterative testing and data to drive significant gains is incredibly insightful. By combining sharp market awareness with direct consumer feedback, you build a pricing strategy that's not just profitable on paper but also compelling in the market.

Implementing a Dynamic Pricing Workflow That Scales

Static, "set-it-and-forget-it" pricing is a relic. Your pricing strategy isn't a document you create once and file away; it's a living system that needs constant attention to protect your margins and capitalize on growth opportunities.

This is the Amplification stage—turning your foundational work and channel optimizations into a scalable workflow that drives measurable results.

The goal is to move from a reactive model—where you only make changes when something is broken—to a proactive, data-driven process. This requires a system for monitoring key variables, a framework for making decisions, and tools that empower your team. Without a structured workflow, your pricing will inevitably fall out of sync with market realities.

Building a Centralized Pricing Calculator

The first step in creating a scalable system is to centralize your pricing logic into a single source of truth. A comprehensive pricing calculator, usually built in a spreadsheet, ensures everyone from marketing to sales is working from the same numbers. This tool becomes the engine of your pricing decisions.

This calculator must be dynamic, allowing you to model different scenarios on the fly.

- Input Variables: Include all key cost inputs like landed cost, channel-specific fees (Amazon referral, FBA), and marketing overhead.

- Output Metrics: Automatically calculate the final retail price, wholesale price, and gross margin for each channel.

- Scenario Planning: Build in functionality to see how a 10% increase in freight costs or a new retailer margin requirement will impact your bottom line.

A well-designed calculator democratizes pricing intelligence across your organization, ensuring consistency and preventing costly errors that arise from siloed data.

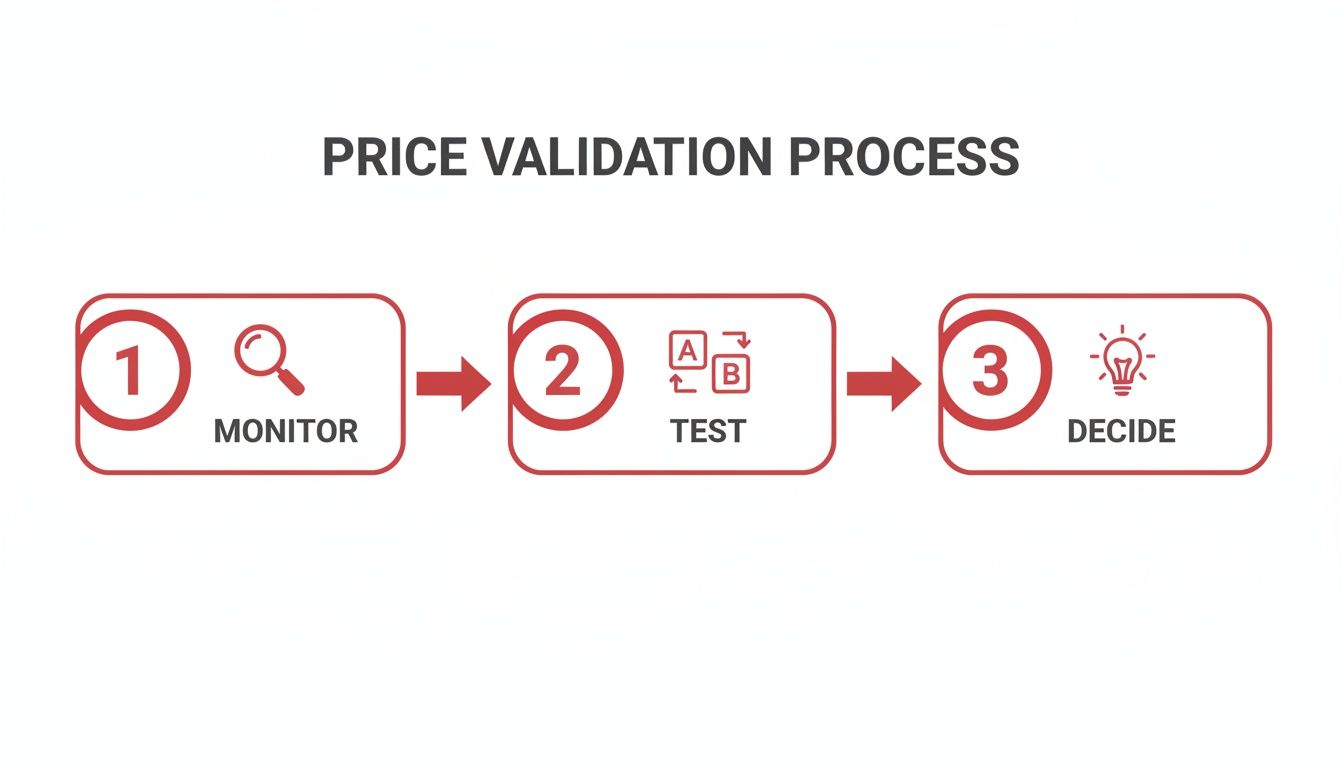

The infographic below outlines a simple but powerful three-step validation process to integrate into your regular pricing reviews, keeping your decisions grounded in current data.

This workflow—Monitor, Test, Decide—transforms pricing from a static calculation into an ongoing optimization loop that adapts to what's happening in the market.

Establishing a Cadence for Pricing Reviews

With your calculator in place, the next step is to establish a regular rhythm for pricing reviews. Ad-hoc adjustments lead to chaos. A predictable schedule ensures you’re always ahead of the curve.

These reviews should be tied to specific business triggers and market events.

Your review cadence should include checkpoints for:

- Seasonal Planning: Reviewing prices quarterly to align with major retail holidays like Q4 or back-to-school.

- Cost Fluctuations: Triggering an immediate review whenever a key input cost, like raw materials or shipping, changes by more than 5%.

- Competitor Movements: Analyzing competitor pricing monthly to identify trends without getting dragged into daily price wars.

This structured approach makes your pricing strategy proactive, not reactive. To better understand the core concepts, check out this straightforward guide on What is dynamic pricing? to see how brands are using real-time data to boost profits.

Key Insight: A dynamic pricing workflow isn't about changing your prices every day. It's about having a systematic process to evaluate if a price change is needed, based on a clear set of internal and external triggers.

Inflation and supply chain stability remain critical variables. While container spot rates have eased and global inflation has moderated, what truly matters is consumer perception. In fact, 43% of consumers still list rising prices as their top concern.

This signals that price sensitivity remains high, meaning brands must carefully justify any price increases with strong value communication.

By implementing this scalable workflow, you create a powerful system for amplification, ensuring your pricing strategy consistently supports brand growth and profitability across all channels. It’s time to take control of your numbers.

Common Questions About Retail Product Pricing

Even with a solid framework, pricing is never simple. Questions always come up, especially when you're balancing profitability with growth. Here are a few of the most common ones we hear from brands, with practical takeaways.

Should My Price Be the Same on All Channels?

Absolutely not. This is one of the most common and costly mistakes growing brands make.

A uniform price across your website, Amazon, and wholesale partners ignores the unique costs and strategic purpose of each channel. Think of it this way: your DTC price on Shopify should be your highest-margin anchor. It’s your home turf.

Your Amazon price must absorb referral and FBA fees, while your wholesale price needs to provide a healthy margin for your retail partners. A smart omnichannel strategy isn't about identical prices; it's about justified prices that ensure you’re profitable everywhere you sell.

How Often Should I Review My Product Pricing?

Pricing isn't a "set it and forget it" task. Markets move, costs fluctuate, and your strategy must adapt. We recommend establishing a regular review cadence to stay proactive.

A simple yet effective schedule includes:

- Quarterly Reviews: Align your pricing with major seasonal shifts and upcoming marketing campaigns.

- Cost-Triggered Reviews: If a key component of your landed cost—like freight or raw materials—jumps by more than 5%, reassess immediately.

- Monthly Competitor Scans: This isn't about copying others. It's a quick check-in on key competitors to understand market trends and ensure your positioning remains sharp.

This workflow turns pricing from a reactive headache into a strategic tool for growth, keeping your strategy tight and your margins protected.

A dynamic pricing workflow isn't about changing your prices daily. It's about having a systematic process to evaluate if a price change is needed, based on clear internal and external triggers.

What if Competitors Are Cheaper Than Me?

First, resist the urge to join a race to the bottom—that's a game no one wins. When you see a lower competitor price, it’s a signal to analyze, not panic.

Before you consider dropping your price, ask these questions:

- Is their product quality truly comparable to mine?

- What is their brand perception versus ours in the market?

- Are they running a temporary promotion, or is this their new standard price?

- Can we better communicate our product's value to justify the price difference?

More often than not, the answer isn't to lower your price but to strengthen your value proposition. Double down on what makes your product better—materials, features, customer service, or brand story—and ensure your customers understand that difference. Protecting your price is about protecting your brand's perceived value.

Is It a Bad Idea to Offer Discounts?

Discounts are not inherently bad, but they must be used strategically. Constant, deep discounts train customers to never pay full price, which erodes brand equity over time.

However, when planned properly, promotions can be incredibly powerful.

The key is to use discounts with a clear purpose: acquiring a new customer segment, clearing out seasonal inventory, or driving traffic during a key sales period. Control is everything. A limited-time offer (LTO) or a "gift with purchase" promotion often works better than a simple percentage-off sale. Why? Because it creates urgency without permanently devaluing your product in the customer's mind.

Building a pricing strategy that fuels growth across every channel is complex, but it's the absolute foundation of a scalable brand. At RedDog Group, we help you connect the dots between cost, margin, and market reality to build a profitable omnichannel presence.

Let’s Talk Growth. Visit us at https://www.reddog.group.

Leave a comment: