Published: March 2020 | Last Updated:November 2025

© Copyright 2026, Reddog Consulting Group.

A go-to-market strategy is your startup's integrated playbook for launching a new product and winning over customers. Think of it as a comprehensive roadmap that aligns your sales, marketing, product, and distribution teams, ensuring everyone is pulling in the same direction to capture the right audience. It's the critical process that prevents the most common startup trap: building a great product that nobody buys.

Let's be direct: most startups don't fail because their idea is bad. They fail because they can't find a market. This is where a Go-To-Market (GTM) strategy becomes your most valuable asset. It's not just another slide in your pitch deck; it's the bridge between a promising product and a profitable, scalable business. It answers the one question that keeps every founder and investor up at night: "How will we actually make money?"

A well-crafted GTM plan forces you to validate your assumptions instead of building in a vacuum. The data is clear. Studies show that around 90% of startups fail, with a staggering 42% citing 'no market need' as the primary reason. That means nearly half of all failed founders never confirmed if people genuinely wanted what they were selling—a fatal mistake that a solid GTM process is designed to prevent.

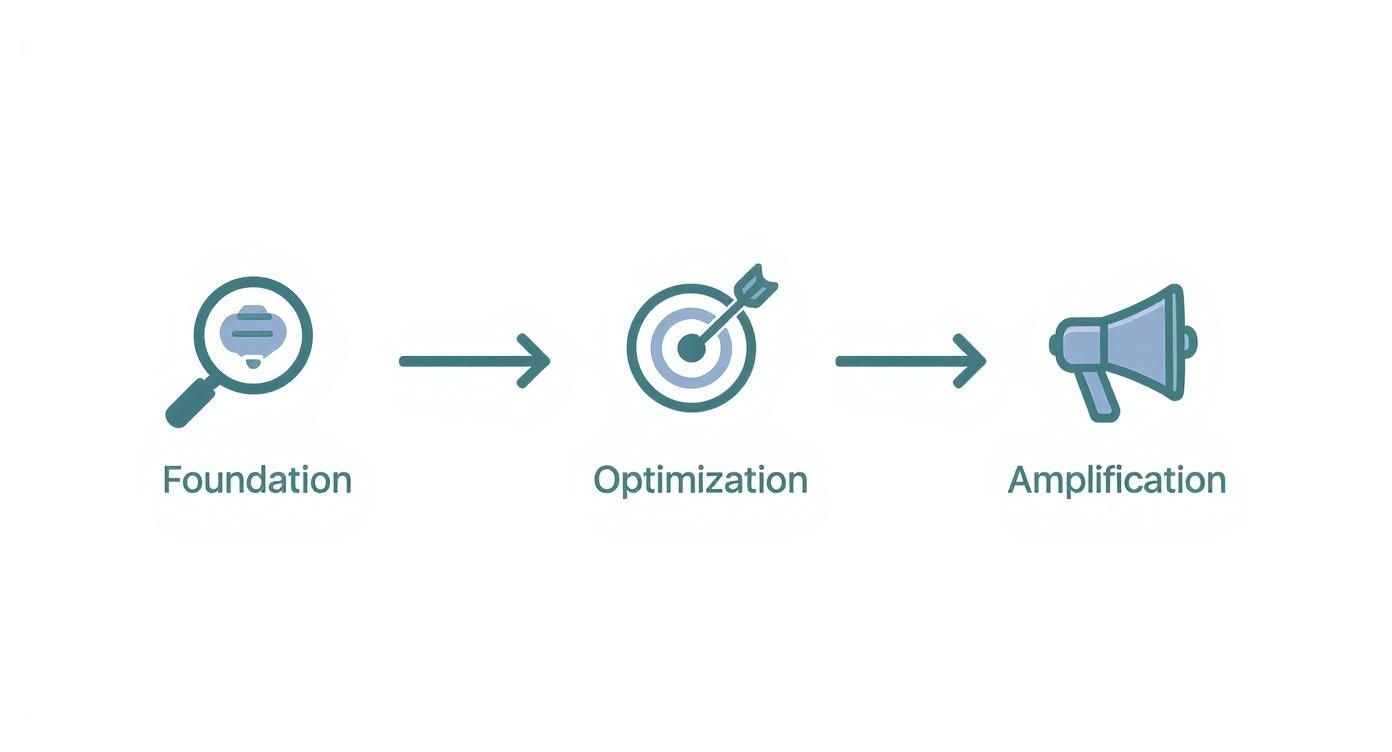

At RedDog, we focus on moving past theory to deliver practical, measurable results. Throughout this guide, we'll walk you through our proven Foundation → Optimization → Amplification framework. This is a clear, step-by-step path designed to help you validate your idea, launch with impact, and build a scalable growth engine from day one.

The visual below illustrates how these pillars work together to build a successful go-to-market strategy for startups.

This framework provides a logical progression. It prevents you from trying to amplify a message before it’s optimized, or optimizing a strategy without a solid foundation of market intelligence.

To help you visualize how these pieces connect, we’ve broken them down into a simple table.

| GTM Pillar | Key Focus | Primary Outcome |

|---|---|---|

| Foundation | Market research, customer discovery, competitive analysis, value proposition. | A clear, evidence-based understanding of who you're selling to and why they should care. |

| Optimization | Messaging, pricing, omnichannel channel selection, unit economics. | A repeatable and efficient model for acquiring and converting customers profitably. |

| Amplification | Integrated marketing campaigns, sales execution, scaling operations. | Measurable, long-term growth and a strong, defensible market presence. |

This table maps out the journey from an initial idea to a scalable business, ensuring each stage builds logically on the last.

A GTM strategy isn’t a one-and-done launch plan; it’s the beginning of a continuous cycle of learning, testing, and growth. It establishes the operational rhythm that underpins true business scalability.

This structured approach ensures your operations, merchandising, and marketing are fully integrated, making every dollar and hour invested work harder. For a deeper tactical view, exploring a comprehensive new product launch strategy playbook can provide additional insights to guide your startup through each critical phase.

Every powerful go-to-market strategy is built on a rock-solid foundation of market intelligence. Forget expensive reports and complex data models for now. This is about rolling up your sleeves and genuinely understanding the world your customers inhabit.

The goal here is simple: replace assumptions with real-world evidence. This groundwork informs every subsequent decision, from product features to your launch campaign messaging. It prevents you from making the classic, costly mistake of building something nobody wants to buy. You must get inside your customer's head, understand their daily frustrations, and pinpoint the exact problems your product solves. Without that clarity, you're just guessing.

The fastest path to clarity is talking to people. This means conducting customer discovery interviews—fact-finding missions, not sales pitches. Your only job is to listen.

Here’s how to do it effectively:

These conversations are invaluable. You’ll hear the exact language your customers use, learn about their clumsy workarounds, and get a true sense of urgency for a better solution.

While getting to know your customers, you also need to understand who else is competing for their attention. A thorough competitive analysis isn't about copying others; it's about identifying your unique opening in the market.

Start by identifying two types of competitors:

Analyze their messaging, pricing, and customer reviews. What are they doing well? More importantly, where are they falling short? Customer complaints about existing products are signposts pointing directly to unmet market needs.

Everything you learn from discovery calls and competitive analysis funnels into one of your most critical assets: the Ideal Customer Profile (ICP). This isn't a vague persona with a creative name. It's a precise description of the perfect customer for your product—the one who gets the most value from it and, in turn, provides the most value to your business.

Your ICP is your North Star. It prevents you from wasting time and money on prospects who will never buy, allowing you to focus all your energy on the people most likely to become your first advocates and drive early growth.

For a B2B startup, an ICP might include firmographics like industry, company size, and annual revenue. For a D2C brand, it may focus more on demographics and psychographics. The key is to be specific. "Small businesses" is too broad. A stronger ICP is "CPG brands with 5-20 employees selling on Shopify and generating $1M-$5M in annual revenue." That level of detail makes every marketing and sales dollar work ten times harder.

Globally, only 15.4% of companies admit to not having a defined GTM strategy, so most businesses understand its importance. However, a significant disconnect exists: 59% feel they underinvest in product launches—a huge risk when 79.5% believe launches have a major impact on revenue. Building this foundational market intelligence is your first step to closing that gap. You can discover more insights on how companies approach their GTM planning and benchmark your own process.

You've done the hard work of listening to the market. Now, it's time to speak. This is where you shift from gathering intelligence to crafting a message that cuts through the noise and carves out a defensible space for your brand.

This isn’t about creating a flashy slogan. It’s about building a core message that resonates so deeply with your ideal customer that your competition becomes irrelevant. Your goal is to become the obvious choice for a specific group of people facing a specific problem.

Your value proposition is the heart of your messaging. It’s a concise statement that answers every customer's fundamental question: “What’s in it for me?” A weak value prop focuses on features. A strong one sells outcomes.

For instance, an inventory management software startup could say they offer "real-time inventory tracking." That's a feature. A much stronger value proposition would be: "Stop losing sales to stockouts. Our software ensures your bestsellers are always on the shelf, helping you maximize revenue." The first describes the tool; the second sells the solution to a painful business problem.

To build a value proposition that converts, ensure it accomplishes three things:

Once your value proposition is locked in, it's time to define your brand’s market position. Brand positioning is the deliberate process of shaping how your target audience perceives you relative to competitors. It’s the story you tell, the voice you use, and the promise you make.

Consider the crowded D2C water bottle market. A brand like Owala positions itself around convenience and clever design for active, on-the-go lifestyles. In contrast, HydroFlask cultivates a rugged, outdoor adventure identity. Same product category, completely different market positions. Your goal is to own a specific idea or feeling in your customer’s mind.

A strong positioning statement acts as your internal compass. It ensures every piece of marketing, every sales call, and every customer interaction reinforces the same core message. This is how you build a cohesive, memorable, and powerful brand.

This process involves identifying your unique differentiators and weaving them into a compelling narrative that connects with your ideal customer. For startups without massive advertising budgets, clear positioning is critical for standing out. Learn more about this foundational step in our detailed guide on what business positioning is and how to craft your strategy.

One of the most common mistakes startups make is leading with product features. The truth is, customers don’t buy features; they buy the benefits those features provide. Your job is to consistently translate what your product does into what your customer gets.

Here’s a simple framework:

| Feature (What it is) | Benefit (What it does for the customer) |

|---|---|

| Made with organic cotton | Softer on your baby's sensitive skin, preventing irritation. |

| AI-powered analytics dashboard | Instantly reveals which marketing channels are most profitable, saving you time and money. |

| One-click checkout integration | Reduces cart abandonment and captures more sales effortlessly. |

This mindset shift is crucial. Every time you write a product description, an ad, or a social media post, ask yourself: am I talking about the tool or the result? Always lead with the result. This benefit-driven approach makes your marketing far more persuasive because it directly connects your product to the tangible outcomes your customers desire.

Where you sell is just as important as what you sell. The right sales channel meets your ideal customer exactly where they already shop, making their path to purchase feel natural and seamless. For any startup, this decision is a critical component of the GTM strategy.

You cannot be everywhere at once. Attempting to do so is a classic startup mistake that leads to drained resources and a diluted focus. The smarter approach is to select one primary channel, dominate it at launch, and then build a strategic roadmap for expansion. This initial choice must align perfectly with your product, customer buying habits, and pricing strategy.

For most CPG and D2C brands, the choice typically narrows down to three core channels. Each has distinct advantages and challenges that can either accelerate your growth or hinder your launch. Understanding these trade-offs is the first step toward a smart, data-driven decision.

Direct-to-Consumer (D2C): Your own ecommerce store, likely built on a platform like Shopify. This channel offers the highest profit margins and gives you complete control over your brand narrative and, most importantly, your customer data. The challenge? You are 100% responsible for driving traffic, which can be costly and time-consuming.

Online Marketplaces: Platforms like Amazon, Walmart Marketplace, or Target+. They provide immediate access to a massive audience of shoppers with high purchase intent. However, you'll face intense competition, lower margins due to fees, and have limited control over branding and the customer relationship.

Wholesale/Retail: This involves selling your product to other retailers who then sell it to the end consumer, either online or in physical stores. It can drive significant volume and lend your brand immediate credibility, but it comes with long sales cycles, complex logistics, and the thinnest profit margins.

The winning playbook is to dominate one channel first. Master it, achieve positive cash flow, and then use that momentum and capital to expand into the next channel. Launching on D2C, Amazon, and wholesale simultaneously will stretch your team too thin.

So, how do you choose that crucial first channel? Go back to your foundation work. Your Ideal Customer Profile (ICP) and value proposition should guide the way.

For example, if you're launching a premium, science-backed skincare line, a D2C website is likely your best starting point. This channel allows you to educate customers with rich content, video tutorials, and direct communication to justify a higher price point—a task nearly impossible on a crowded Amazon page. This direct connection also helps you build a loyal community.

Conversely, if you're launching a simple but innovative kitchen gadget, Amazon might be the perfect launchpad. Customers searching for "kitchen gadgets" are already there, ready to buy. You can leverage Amazon's fulfillment network (FBA) and built-in traffic to generate sales and reviews quickly, validating market demand for your product.

To help you visualize the trade-offs, here’s a quick comparison of the most common channels for a new CPG brand.

This table breaks down the strategic considerations for each channel. Your choice should be a calculated bet based on your product, team capabilities, and funding.

| Channel | Key Advantages | Key Challenges | Best For... |

|---|---|---|---|

| Direct-to-Consumer (D2C) | Highest margins, full brand control, direct customer data ownership. | High traffic acquisition costs, complex fulfillment, slower initial growth. | Niche products requiring education, community-focused brands, high LTV items. |

| Online Marketplaces | Massive built-in audience, trusted platform, streamlined fulfillment (FBA). | Lower margins, intense competition, limited branding, no customer ownership. | High-demand products, items with clear search intent, brands needing fast validation. |

| Wholesale / Retail | High sales volume, broad reach, increased brand legitimacy. | Lowest margins, long sales cycles, complex logistics and compliance. | Established brands with proven demand, products suited for impulse buys. |

Remember, your channel strategy is not static; it's designed to evolve. A brand might launch on D2C to build a loyal base, then expand to Amazon to capture a wider audience, and finally leverage that traction to secure deals with major retailers. This phased approach, moving from Optimization to Amplification, ensures each step is built on a solid, profitable foundation.

With a clear message and a selected channel, it's time to execute. This is the "Amplification" phase, where your go-to-market plan transforms from a document into a living launch. The goal is to generate initial momentum and establish a tight feedback loop with your first customers.

For a startup, successful amplification isn't about a massive, expensive marketing blitz. It’s about precision and impact. A well-structured launch timeline with clear milestones is your best friend, ensuring every action—from pre-launch buzz to post-purchase follow-up—is deliberate and drives you toward your goals.

The best product launches begin weeks, or even months, before launch day. Your mission is to cultivate an audience of eager early adopters who are ready to buy the moment you go live. This strategy creates a powerful initial surge of sales and social proof.

Here are a few high-impact, low-cost tactics to build crucial pre-launch hype:

Launch day is about activating the audience you’ve spent weeks building and making it incredibly easy for them to purchase. Your timeline should detail a clear sequence of events, from sending a launch email to your pre-vetted list to posting coordinated announcements across your social channels.

Concentrate your marketing energy into a short window to create a spike in activity. This not only drives critical first sales but also signals to platform algorithms (like Amazon's or Instagram's) that your product is trending, which can boost your organic visibility long after launch day.

Your launch isn't just about making sales. It's your first major opportunity to gather data and feedback at scale. Every interaction, purchase, and customer question is a piece of intelligence that will inform your next strategic move.

Once the initial launch buzz subsides, your focus must shift immediately to measurement. You need to know what’s working and what isn't by tracking the right Key Performance Indicators (KPIs). For startups, vanity metrics like impressions or follower counts don't drive the business forward.

Instead, zero in on these critical launch KPIs:

Closely monitoring these metrics provides a clear, data-driven picture of your launch performance. It allows you to double down on successful tactics and quickly cut what's draining your budget.

The amplification stage is also about planting the seeds for long-term, sustainable growth. While early tactics should provide quick wins, they must also build assets that deliver value for months and years to come. To truly amplify your launch and secure long-term visibility, implementing proven SEO strategies for startups is a must. Foundational SEO may not deliver a huge spike on day one, but the work you do now will build organic traffic over time, reducing your reliance on paid channels.

This principle extends to the technology you adopt. AI-native startups are setting a new standard for GTM success, achieving significantly higher conversion rates than their peers. For companies with $100 million or more in annual recurring revenue, free trial conversion rates average 56% for AI-native firms, compared to just 32% for others. This demonstrates how integrating smart tools from day one creates a powerful competitive advantage.

These early tactics are often part of a broader strategy known as growth hacking. For a deeper look at this approach, explore our guide on what growth hacking is and how to use it. By blending immediate launch tactics with long-term foundational work, you set your startup on a path to scalable, profitable growth.

Even with a clear framework, questions are natural. Putting a go-to-market strategy into practice can feel complex, so let's address some of the most common uncertainties we hear from founders.

This is a critical distinction. A marketing plan is your ongoing, year-round playbook for building brand awareness and generating leads. It’s the engine that continuously runs to support the business.

A go-to-market (GTM) strategy, on the other hand, is a focused, comprehensive plan for a specific product launch. It is the master blueprint that integrates not just marketing but also sales, pricing, distribution, and customer support to successfully introduce a new product to the market. While a GTM strategy includes marketing tactics, its scope is much broader.

There's no single magic number; the budget depends heavily on your industry, product, and chosen channels. The biggest mistake is not having a dedicated budget at all. Instead of picking a number arbitrarily, work backward from your goals.

For example, if your objective is to acquire 1,000 customers in the first 90 days, you must estimate your Customer Acquisition Cost (CAC) for each planned channel. Your budget should be grounded in that data-driven calculation, not a gut feeling.

For very early-stage startups, much of the initial "budget" is sweat equity—content creation, community engagement, and manual outreach. This is often supplemented by a performance marketing budget of $5,000 to $25,000 to run initial ad tests and validate channel effectiveness.

Your GTM budget is not just a marketing expense; it's an investment in market validation. The goal is to spend just enough to learn whether your core assumptions about your customer and channels are correct before you scale.

Far earlier than you probably think. The ideal time to start building your go-to-market strategy is in parallel with product development—not after the product is already built.

The research phase of your GTM, our Foundation pillar, should directly inform what you build. Waiting until your product is fully coded and polished is a classic—and often fatal—startup mistake, as you risk building something nobody truly needs.

Begin customer discovery interviews and market validation before writing a single line of code or creating a prototype. You can then finalize the full launch plan as the product nears completion, confident that it is being built to solve a real-world problem.

During your initial launch, resist the temptation to focus on vanity metrics like impressions or follower count. You need to track the KPIs that validate your core business model and prove you have a viable path to profitability.

Here are the metrics that truly matter early on:

Crafting and executing a powerful go-to-market strategy requires a deep, integrated understanding of every channel. At RedDog Group, we specialize in building omnichannel growth plans that turn great products into profitable, enduring brands.

Article created using Outrank

1500 Hadley St. #211

Houston, Texas 77001

growth@reddog.group

(713) 570-6068

Amazon

Walmart

Target

NewEgg

Shopify

Leave a comment: